Private investment firm AE Industrial Partners has signed a definitive agreement to acquire a controlling interest in the Space Propulsion and Power Systems business of L3Harris Technologies. The transaction encompasses business units across five locations in the U.S., which have developed the upper-stage rocket engines used in national security, civil and commercial missions for more than 60 years, as well as in-space propulsion, nuclear power and avionics assets.

L3Harris will retain a minority investment interest and continue to act as a strategic partner to the business. AE Industrial plans to restore and use the “Rocketdyne” name for the acquired business in recognition of its heritage and longstanding innovation within space propulsion technology.

AE Industrial Partners Managing Partner Kirk Konert said that in addition to restoring a legacy name to the commercial space industry, the acquisition is part of a new paradigm following a round of company consolidations over the past few decades.

“And now what we’re seeing is a kind of de-consolidation and new entrants being introduced into the market, and this is part of that theme in a new way, “Konert said. “Where L3, a prime, has been part of that consolidation over the past couple of decades is now partnering with a specialized investor such as AE Industrial to re-invigorate and stand alone a new platform in Rocketdyne which includes some of the key workhorses of propulsion for our space and national security programs here in the U.S.”

The partnership between AE Industrial and L3Harris will also aim to help accelerate the development of future propulsion technologies, including nuclear propulsion, which will be critical to the exploration of Mars and the cislunar domain. We’ll hear more about AE Industrial later in the program.

-0-

The U.S. Space Development Agency (SDA) has named Rocket Lab as the prime contractor tasked with the design and manufacture of 18 satellites for the Tracking Layer Tranche 3 (TRKT3) program under the Proliferated Warfighter Space Architecture (PWSA). The award, valued at $816 million, is the company’s largest single contract to date.

Under the contract Rocket Lab will deliver satellites equipped with advanced missile warning, tracking, and defense sensors to provide global, persistent detection and tracking of emerging missile threats, including hypersonic systems. The award includes an $806 million base contract plus up to $10.45 million in options. Each satellite will feature Rocket Lab’s next-generation Phoenix infrared sensor payload, a wide field-of-view (WFOV) solution designed to meet the evolving missile defense needs of national security in space. To ensure mission resilience, the satellites will be equipped with Rocket Lab’s advanced StarLite space protection sensors, designed to safeguard the constellation against directed energy threats. Notably, StarLite sensors have also been adopted by other prime contractors developing TRKT3 satellites, further expanding Rocket Lab’s role in the program

Rocket Lab’s satellites will be built on its proven Lightning platform, leveraging the company’s vertically integrated manufacturing capabilities to deliver an unmatched combination of speed, cost efficiency, and quality. All major components – from solar arrays, reaction wheels and star trackers to propulsion systems, avionics, payloads, and launch dispensers – are designed and produced in-house.

Rocket Lab’s growing role as a prime contractor for the U.S. Space Force highlights its emergence as a formidable competitor to legacy aerospace primes.

-0-

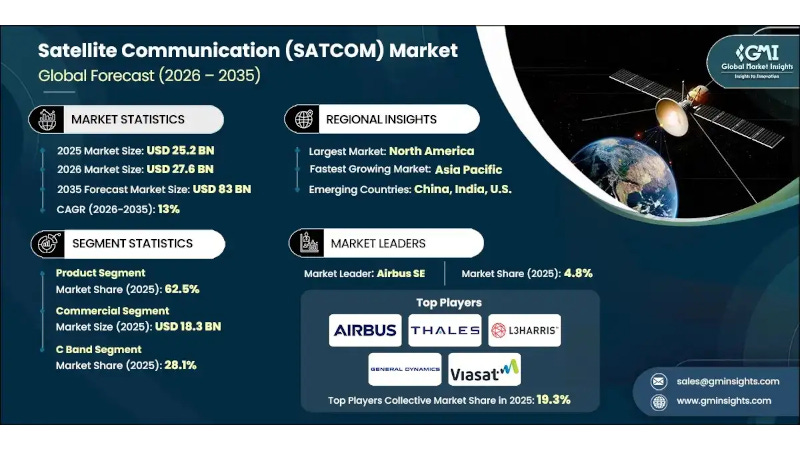

The global satellite communication market, which was valued at $25.2 billion last year, is expected to grow from $27.6 billion this year to $47.6 billion in 2031 and $83 billion in 2035, at a CAGR of 13% during the forecast period. That’s according to a new report published by Global Market Insights.

The expansion of demand for internet connectivity, development of small satellite constellations to enhance communications, demand for remote area connectivity, increased demand for IoT & M2M Connectivity, and the integration of 5G with existing infrastructure and new technologies are several factors that propel satellite communications market growth.

The growing demand for reliable internet depends on satellite communications expanding into underserved areas. Programs Like NTIA’s Internet for All project highlight the need for equitable access to broadband. For example, in rural areas, over 72% of tribal broadband connectivity program funds were awarded to rural areas, which is why satellite communications is important to provide high-speed communications to areas where terrestrial infrastructure is not available.

The analysts found that the rapid expansion of satellite constellations is a key trend in the SATCOM market, as demand for worldwide high-speed broadband is a key factor driving this growth.

A partnership that could result in the first in-space advanced materials manufacturing facility for the manufacture of semiconductors has been announced by United Semiconductors and Aegis Aerospace.

The collaboration follows Aegis Aerospace’s recent grant agreement with the Texas Space Commission to develop an in-space manufacturing platform for advanced materials in low Earth orbit.

The Aegis Advanced Materials Manufacturing Platform (AMMP) aims to showcase the unique properties and manufacturing capabilities afforded by the microgravity environment of LEO. By leveraging United Semiconductors’ established expertise as a provider to the U.S. Department of War, this partnership will expedite the commercialization of semiconductor manufacturing in space. As a result, Aegis Aerospace anticipates creating new job opportunities in Texas and offering this innovative service globally.

Together, Aegis Aerospace’s AMMP and United Semiconductors products are believed to be the first dedicated commercial facility for in-space materials production.

-0-

On our most recent edition of The Journal of Space Commerce podcast, Tom Patton talked with Kirk Konert, Managing Partner of AE Industrial Partners, a private investment firm focused on technologies and services considered critical to aerospace and national and economic security. The company was founded in 1998 by father-son team Brian and David Rowe, and currently manages $7.2 billion in assets from their headquarters in Boca Raton, FL.

AE Industrial Partners supports multiple verticals in the commercial space sector, with several companies involved in the space supply chain. Company co-founder Brian Rowe came from GE Aviation, and the company still is interested in things that fly, and things that make things fly.

The company has also invested in such firms as Firefly Aerospace, York Space Systems, Redwire and others. In fact, Konert said that AEI has been the most active private investment firm in space over the past several years.

“We believe space has been at an inflection point in industrialization, where it’s become a key part of our economy and infrastructure for driving our economy globally. And without space as a backbone of that infrastructure our modern day economy sort of collapses at this point.”

The company says it makes investments to positively impact its target markets, portfolio companies and the communities within which they operate. Each investment has unique characteristics which requires a flexible approach to meet the needs of all stakeholders.

-0-

In depth this week (paywall), Jared Isaacman was confirmed December 17th as NASA Administrator, and the next day, President Trump issued an executive order dissolving the National Space Council and mandating Americans return to the Moon by 2028. That timing wasn’t accidental. Together, these moves signal a coordinated restructuring of American space policy, shifting power from traditional aerospace contractors toward commercial providers and fundamentally rewriting the rules for who profits from space exploration.

Before confirmation hearings even began, a 62-page document titled “Project Athena” leaked to Politico, revealing Isaacman’s vision in remarkably blunt terms. The plan sorts NASA programs into three categories: accelerate, fix, or delete. That last category has congressional offices scrambling.

Project Athena pulls no punches on legacy programs. The Space Launch System—NASA’s heavy-lift rocket that has cost approximately $24 billion in development and flown once—would terminate after Artemis III and potentially Artemis IV. The lunar Gateway space station, consuming years of international partnership development, would be canceled entirely. In their place, Isaacman proposes accelerating commercial lunar landers and focusing deep-space ambitions on Mars missions powered by nuclear electric propulsion. And the plan reserves particularly sharp criticism for the Jet Propulsion Laboratory, calling its cost-plus contract structure “outdated” and suggesting JPL should compete like any other contractor rather than receive directed funding.

Beyond program cuts, Project Athena targets NASA’s organizational structure. The plan proposes consolidating mission control operations at Johnson Space Center in Houston, potentially stripping responsibilities from other centers. It calls for comprehensive reviews of center “modernization”—language that typically precedes workforce reductions and facility closures. Isaacman’s vision isn’t just about changing which rockets NASA flies; it restructures how the agency operates, shifting from in-house development toward contract oversight.

Our in-depth report looks at the ramifications for the commercial space industry given Isaacman’s vision for NASA, and the impacts of Trump’s most recent executive order related to the agency. Where budgets are concerned, the Trump administration’s proposed FY2026 NASA budget included significant cuts that space policy publications described as potentially “devastating” to specific programs. While final appropriations always differ from initial proposals—Congress historically adds funding back for programs like Artemis—the direction is clear: legacy programs face pressure while commercial partnerships receive emphasis.

Near-term decisions in this year will determine which programs survive. SLS production for missions beyond Artemis IV requires funding decisions in the next appropriations cycle. Gateway hardware currently under construction either continues, or faces cancellation penalties. Commercial lunar lander providers either receive follow-on contracts or watch NASA’s architecture shift to alternatives. Each choice cascades into workforce planning, facility utilization, and supplier relationships across the industrial base.

Isaacman told CNBC shortly after confirmation that Americans will return to the Moon within Trump’s term—a promise representing either bold confidence or unrealistic optimism depending on how much organizational inertia he overcomes. Either way, the transformation he’s initiating represents the most significant restructuring of America’s space program since NASA’s founding, with winners and losers becoming apparent well before that lunar landing occurs.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the “In Depth” tab. And while you’re there, paid subscribers can also read about Amazon’s “LEO” gamble, the risks of going “Fabless”, and what happens ground stations become a data bottleneck.