Satellite Communication Market Could See Double-Digit Growth Through 2031

CAGR of 13 Percent Projected by Global Market Insights Inc.

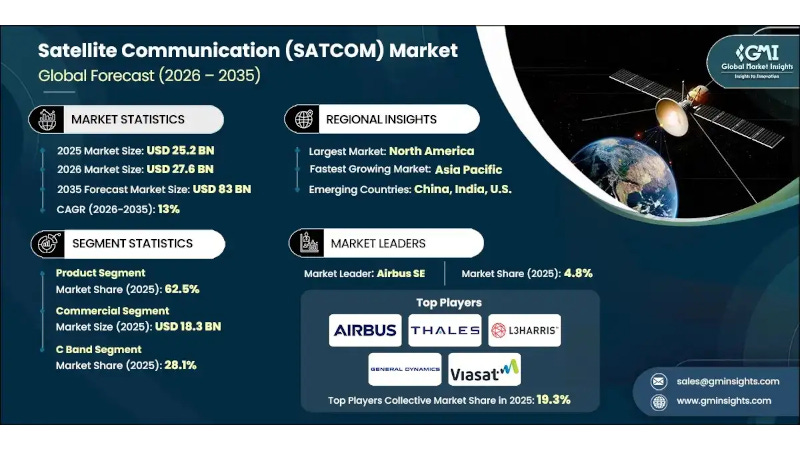

The global satellite communication market, which was valued at $25.2 billion in 2025. The market is expected to grow from $27.6 billion in 2026 to $47.6 billion in 2031 & $83 billion in 2035, at a CAGR of 13% during the forecast period according to the latest report published by Global Market Insights Inc.

The expansion of demand for internet connectivit…