The U.S. Space Force Space Development Agency (SDA) has awarded a $52.5 million contract to Starfish Space to provide Deorbit-as-a-Service (DaaS) for satellites within the Proliferated Warfighter Space Architecture (PWSA). The award is the first such contracted mission for end-of-life satellite disposal service for any provider.

Under the contract, Starfish Space will build, launch, and operate an Otter spacecraft in low Earth orbit (LEO) to safely and efficiently dispose of SDA satellites at the end of their operational lives. The mission begins with an initial deorbit, with options for multiple additional deorbits, enabled by Otter’s significant capacity and ability to service several satellites in a single mission.

As LEO constellations continue to expand and require refresh cycles, operators must put more emphasis on managing end-of-life disposal safely, reliably, and at scale. Until now, operators have only had two options for managing end-of-life: actively deorbit satellites prematurely to mitigate risk of early failure and resulting operational hazards, or fly satellites for longer and contend with increasing debris and collision risks across their constellation. With Deorbit-as-a-Service, operators have a better alternative: maximize the operational life and value of their constellations and rely on vendors to dispose of any satellites which cannot dispose of themselves.

The mission, which is targeting a 2027 launch date, will demonstrate how commercial Deorbit-as-a-Service can support both government and commercial constellation operators, maximizing the value and capabilities LEO operators can derive from their constellations as they continue to scale.

###

In a related development, the European Space Agency (ESA) has awarded a contract valued at more than $475,000 to Astroscale UK to lead the design of the In-Orbit Refurbishment and Upgrading Service (IRUS). The novel mission concept is designed to lead to technology that will enable satellites to be upgraded, repaired, and extended while in orbit. This initiative supports ESA’s Space Safety Program, reinforcing Europe’s commitment to reducing orbital risks and ensuring safe operations for future generations.

With the involvement of the spacecraft manufacturer and operator BAE Systems in the role of a future in-orbit servicing client, IRUS represents a major step towards a circular space economy, where satellites are maintained, repaired and enhanced in orbit rather than treated as single-use. Developing this new capability will pave the way for more complex In-Orbit Servicing, Assembly and Manufacturing (ISAM) capabilities – as refurbishment and upgrading are essential precursors to assembling and manufacturing platforms in space.

The eight-month Phase A study contract will develop the technical groundwork and commercial case for in-orbit refurbishment and upgrading services. The team will explore how robotic and servicing technologies can safely connect with and refurbish satellites already in orbit, assessing the technical feasibility and commercial viability of upgrading a satellite or extending its life through replacing degraded or out-of-date subsystems such as batteries, solar panels and on-board computers.

###

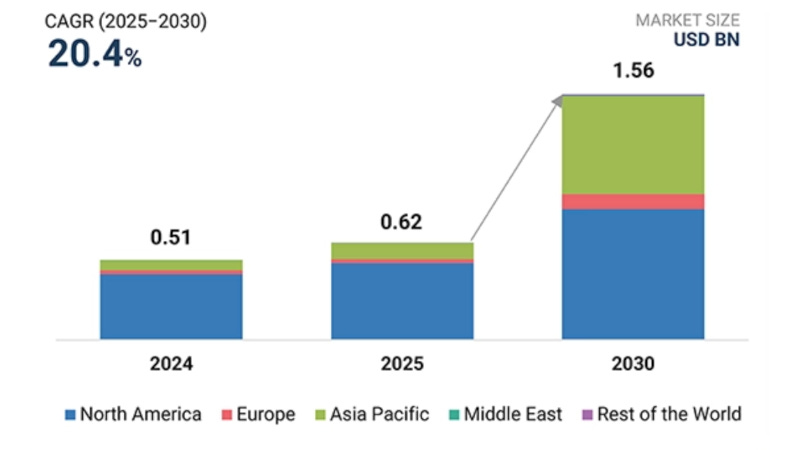

The Optical (laser) Satellite Communication Market is projected to grow from $620 million in 2025 to $1.56 billion by 2030 at a CAGR of 20.4%, according to a new report from MarketsandMarkets. The market is growing steadily, driven by a growing need for secure, high-capacity data links across space missions, defense applications, and commercial satellite networks. Improvements in laser terminal pointing and tracking systems, along with AI-based link management, are making these systems more reliable and easier to operate.

The demand is rising for high-capacity inter-satellite links, secure data transmission, and low-latency connectivity across LEO and multi-orbit satellite constellations. The optical (laser) satellite communication market is driven by the need for high-throughput and secure data links to support growing satellite data traffic. There is an increase in the adoption of laser inter-satellite links in LEO constellations, and demand for low-latency connectivity across defense and commercial missions is a key growth factor.

By component, the Pointing, Acquisition, and Tracking (PAT) module segment is projected to account for the largest market share during the forecast period. By application, the network backbone and relay communications segment is expected to see the highest growth, driven by the use of optical intersatellite links to build space-based mesh networks that reduce dependence on ground stations.

North American accounted for a 67.9% market revenue share in 2024. However, the Asia Pacific region is expected to be the fastest-growing region during the forecast period.

###

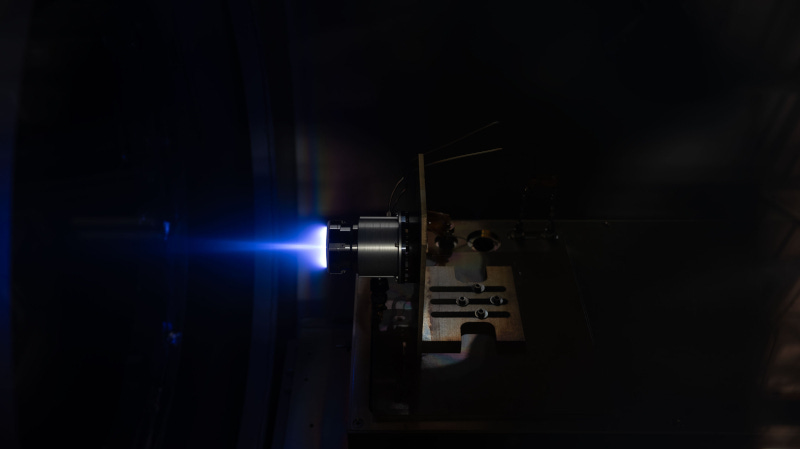

A milestone year has been reported by Astra, showing $45 million in revenue for 2025, breakeven EBITDA and 100% satellite engine mission reliability. The company says it has shipped 110 satellite engine systems in the past calendar year, surpassing a key operating milestone set when the company went private in 2024.

Astra shipped the 110 systems with a team of approximately 100 employees, reflecting operating leverage driven by tighter process gating, increased automation, and execution discipline across manufacturing, test, and their supply chain. All systems are designed, manufactured, and tested at Astra’s Alameda, California facility.

A series F funding round coming in at just under $130 million has been closed by Interstellar Technologies through a third-party allotment of new shares. The round was completed with the investments from SBI Group, Nomura Real Estate Development, B Dash Venture, SMBC Edge, and existing shareholders, in addition to the previously announced investors, and represents one of the largest fundraising efforts to date by a privately held space startup in Japan.

The round, led by Woven by Toyota, raised $95.5 million through a third-party allotment of preferred shares in an up-round. In addition, the company secured just over $34.2 million in debt financing from financial institutions, including loan facilities with stock acquisition rights provided by the Japan Finance Corporation.

Alongside the fundraising, secondary transactions with existing shareholders were also conducted to optimize the company’s capital structure. Nomura Securities provided advisory support in this series, including the introduction of several potential investors, some of which resulted in fundraising.

The funds raised in this round will be used primarily for the development of first ZERO orbital launch vehicle, strengthening the manufacturing system toward future commercialization, and the research and development of satellites, thereby driving further expansion of both businesses.

###

Launch timing for the BlueBird 7 mission has been announced by AST SpaceMobile. The launch is currently scheduled for late February from Launch Complex 36 at Cape Canaveral Space Force Station on Blue Origin’s New Glenn launch vehicle.

Identical to BlueBird 6, BlueBird 7 is the second satellite in AST SpaceMobile’s next-generation campaign. At nearly 2,400 square feet, it features the largest commercial communications array in low Earth orbit, 3.5 times larger than BlueBirds 1-5. Its size and design, built on significant technical innovation and supported by more than 3,800 patent and patent-pending claims, enable peak data rates of up to 120 Mbps space-based broadband connectivity for voice, data, and streaming.

The next generation BlueBirds are designed to be compatible with all major launch vehicles. Future missions on New Glenn are expected to deliver up to 8 next generation BlueBirds per flight, with its seven-meter fairing enabling twice the payload volume of five-meter class commercial launch systems.

###

In depth this week, the satellite industry faced a supply chain nightmare in 2022, with critical components like optical communication terminals and radiation-hardened processors backordered for 18 months. Industry analysts predicted widespread deployment delays that would cripple the booming constellation business. But those delays never materialized—at least not for commercial operators. (Paywall)

According to industry data, constellation operators achieved 94% of their planned launch targets despite the crisis. SpaceX launched 96 missions in 2023 alone, more than all other launch providers worldwide combined. OneWeb finished deploying its 648-satellite constellation on schedule by 2023.

The secret? Commercial operators rebuilt their supply chains from scratch rather than waiting for global markets to recover. Companies like SpaceX doubled down on vertical integration, manufacturing critical components in-house at their Redmond, Washington facility—a strategy industry veterans initially dismissed as inefficient.

The approach created what one analysis calls “a parallel manufacturing economy” built on three pillars: making components internally, stockpiling critical parts, and simplifying satellite designs to reduce dependencies.

The strategy worked. While component shortages were real—German optical terminal maker Mynaric nearly went bankrupt before being acquired—commercial operators maintained their production pace through manufacturing flexibility unavailable to competitors.

The exception highlights the rule: The Space Development Agency, bound by government procurement regulations, experienced exactly the delays commercial operators avoided on their Tranche 1 satellite constellation.

Industry observers say these manufacturing changes aren’t temporary fixes but represent a permanent shift in constellation economics, widening the gap between operators controlling their own production and those relying on traditional supply chains.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the Supply Chain tab, where you can also find deep dives on Supply Chain Sovereignty in Rare Materials, The Strategic Premium on Supply Chain Gaps, and The CEO Playbook for Supply Chain Resilience.

Theme Stock Music Provided by Pond 5

Worth a Second Look

Integration Milestone Achieved for LizzieSat‑4 Mission

Contract for Propulsion Subsystem for LISA Mission Signed

New Glenn-3 to Launch AST SpaceMobile’s BlueBird Satellite

First AI-Native Space-Based Weather-Sensing Constellation Announced

Inside Orbital Reef (Paywall)