Bipartisan legislation to provide regulatory predictability to the satellite industry, boost high-speed Internet access, and ensure American space leadership has been introduced in the U.S. Senate by U.S. Senate Commerce Committee Chairman Ted Cruz (R-TX) and Senator Peter Welch (D-VT).

The SAT Streamlining Act establishes a clear, one-year deadline for the FCC to make a decision on a license application. These changes would help expand broadband access to underserved areas, and incentivize commercial satellite operators to base operations in the United States over foreign jurisdictions where satellite application processes may be less burdensome. The legislation also standardizes “market access” for foreign satellite systems operating in the United States by capping licenses at 15 years, aligning them with the 15-year approval term applied to U.S. companies.

The legislation establishes strict deadlines for the FCC to act on applications. The agency would have one year to approve or deny applications for satellite licenses, including those for geostationary and non-geostationary orbit space stations and earth stations. If the FCC misses these deadlines, applications would be automatically approved.

For license renewals, the FCC would have 180 days to make decisions. Minor technical modifications to licenses would need to be processed within 90 days, while certain equipment replacement requests would get expedited 30-day reviews.

Tom Stoup is the president of the Satellite Industry Association. He says the industry will benefit greatly from a standardized process.

“Members of Congress realize that the industry has grown so rapidly that we need to find ways to be able to expedite the licensing process. And I think in a nutshell, that’s really it,” Stroup said. “I mean, it’s just like The FCC has done a great job of dealing with some of the backlog and applications. And there’s a proceeding at the FCC on creating a new set of rules with their modernization proceeding. And I think, again, it all ties into a recognition of the growth in the industry and the importance of the national economy.”

The bill emphasizes that the U.S. space industry is vital for the economy and job creation. It aims to ensure America maintains global leadership in commercial space by modernizing regulatory processes to keep pace with industry innovation.

-0-

A new demonstrator called Airbus UpNext SpaceRAN (Space Radio Access Network) has been launched into orbit. Its mission is to enable standardized global connectivity by exploring advanced 5G Non-Terrestrial Network (NTN) capabilities. This demonstrator aims to explore the 5G NTN, a versatile connectivity technology compatible with all types of business applications.

The demonstration will confirm the feasibility of providing universal connectivity that is standardized, interoperable, and globally available for commercial, defence or governmental use.

Airbus UpNext SpaceRAN will leverage Airbus’ software-defined satellite 1 capabilities to manage and optimize 5G signals in orbit. By processing data directly in space rather than simply relaying it, the demonstrator 2 will prove that we can reduce latency, maximize data throughput, and enable more efficient network management and routing, opening the door to user-to-user direct connectivity.

Developed as part of Air!5G, a project supported by the French government through the France 2030 investment plan under the Future Networks strategy, this demonstrator is expected to show its first results by 2028.

-0-

In anticipation of its Initial Public Offering, York Space Systems has launched the roadshow for the IPO of 16,000,000 shares of its common stock.

In addition, York intends to grant the underwriters a 30-day option to purchase up to an additional 2,400,000 shares of its common stock at the initial public offering price, less underwriting discounts and commissions. The initial public offering price is expected to be between $30 and $34 per share.

York has applied to list its common stock on the New York Stock Exchange under the ticker symbol “YSS.”

A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

The first Rocket Lab launch of 2026 successfully lifted two spacecraft into orbit for European space technology company, Open Cosmos.

That’s Murielle Baker is the Director of Corporate and Launch Communications at Rocket Lab. “On board Electron today are two small sats by Open Cosmos that are heading to a 1,050 kilometer low Earth orbit at an 89 degree inclination. The pair will verify new capabilities that Open Cosmos is developing, and it is the first time flying on Electron for the Open Cosmos team.

The mission ‘The Cosmos Will See You Now’ lifted off from Launch Complex 1 in New Zealand at 11:52 p.m. local time on January 22. The two spacecraft were deployed into an ≈652 mile low Earth orbit. It was the company’s 80th electron launch overall.

The story was a bit different at Launch Complex 3 in Wallops Island, Virginia however. Rocket Lab released a statement saying that qualification testing of the Stage 1 tank for its larger Neutron rocket Wednesday night resulted in a rupture during a hydrostatic pressure trial. The company stressed that testing failures are not uncommon during qualification testing, and that structures are intentionally stressed to their limits to validate structural integrity and safety margins and ensure the robust requirements for a successful launch can be comfortably met.

The Company intends to provide an update on the Neutron schedule during its 2025 Q4 earnings call in February.

-0-

Integration has begun on the Vast Haven-1 commercial space station. Scheduled to be the world’s first private space station, Haven-1 is designed as a standalone, crewed station and serves as the first step for Haven-2, a multi-module station capable of supporting a continuous human presence in low-Earth orbit (LEO) that is Vast’s proposed successor to the ISS.

The first phase of Haven-1 integration includes installation of the station’s pressurized fluid systems, including thermal control, life support, and propulsion system tubes, and component trays and tanks. These systems will undergo pressure, leak, and functional testing. The second phase of integration will incorporate avionics, guidance, navigation and control systems, and air revitalization hardware. The third and final phase will complete the vehicle with crew habitation and interior closeouts, exterior micrometeoroid and orbital debris (MMOD) shielding, thermal radiator installation, and solar array integration, bringing Haven-1 to a fully flight-ready configuration.

Based on the current integration timeline, Vast is updating its schedule for Haven-1 to be ready to launch Q1 2027.

-0-

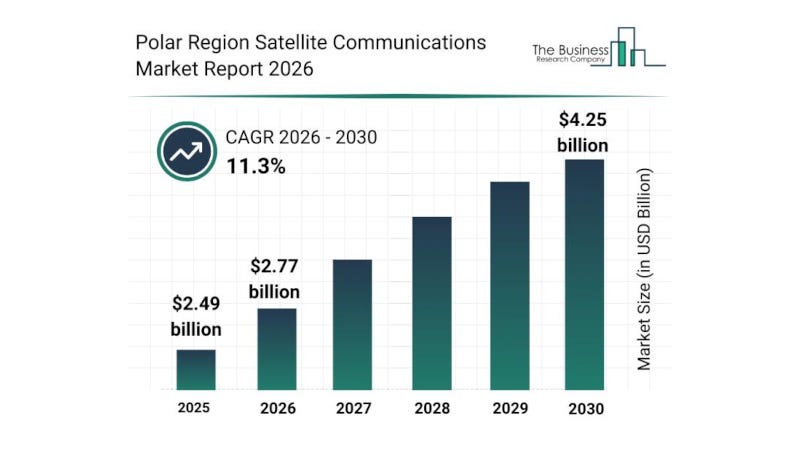

The polar region satellite communications industry is on the verge of significant expansion, driven by increasing technological advancements and growing needs for connectivity in extreme environments. According to new analysis from The Business Research Company, as demand intensifies for robust communication systems in the Arctic and Antarctic, the market is set to experience remarkable growth in the coming years.

The polar region satellite communications market is anticipated to reach a value of $4.25 billion by 2030, showcasing a strong compound annual growth rate (CAGR) of 11.3%. This surge is largely fueled by the deployment of low-earth orbit (LEO) satellite constellations specifically focused on polar coverage, integration with Arctic navigation and surveillance systems, and the increasing use of AI-powered communication optimization technologies. Additionally, expanding activities in polar resource exploration and a growing reliance on emergency and disaster communication services further contribute to this robust growth. Key trends expected to shape the market include the expansion of LEO constellations to enhance polar communication, rising demand for resilient systems to support Arctic shipping, increasing scientific research requiring high-bandwidth data transmission, widespread adoption of portable satellite terminals for fieldwork, and advancements in high-frequency Ka- and Ku-band solutions designed to withstand harsh weather conditions.

One critical driver of market expansion is the rollout of low-earth orbit satellite constellations tailored for polar regions. These constellations improve connectivity and coverage in remote areas, supporting a variety of applications from scientific missions to commercial operations.

-0-

In depth this week, Congress has handed NASA its biggest budget in nearly three decades, and with it, a clear mandate: put commercial space companies at the center of America’s future in orbit and on the Moon. (Paywall)

On January 15, lawmakers approved a $27.5 billion package for NASA for fiscal year 2026, combining traditional appropriations with a special reconciliation bill. The move reverses a proposed 24 percent cut from the Trump administration and instead boosts funding for exploration systems, science, and new commercial space stations in low Earth orbit. It also cements a bipartisan deal that treats commercial partnerships not as experiments, but as national infrastructure.

At the heart of the shift is a new role for NASA as an “anchor customer” rather than the builder and operator of its own spacecraft and stations. Reauthorization language led by Senators Maria Cantwell and Ted Cruz instructs the agency to use commercial capabilities “as appropriate and practicable” for lunar missions, cargo runs, and low Earth orbit operations, tilting policy in favor of private providers unless safety or technical issues get in the way.

The money will flow into two big arenas. First, commercial space stations: NASA’s Commercial LEO Destinations program will pick at least two station providers this April, with about $1 to $1.5 billion in funding over five years and the promise of long-term NASA tenancy after the International Space Station retires around 2030. Companies like Blue Origin and Sierra Space with their Orbital Reef concept, Axiom Space with its ISS-attached modules, Voyager Space and Airbus with Starlab, and newcomer Vast are all vying to become the next platforms where astronauts, researchers, and private customers work and live in orbit.

Second, the Moon: NASA is putting $250 million into its Commercial Lunar Payload Services program this year and has shifted it under the Artemis exploration umbrella. Multiple private lander companies will compete to deliver NASA and commercial payloads to the lunar surface, including missions by Intuitive Machines, Astrobotic, and Firefly that together represent hundreds of millions of dollars in contracts and could set the pace for a broader lunar economy.

But this new era comes with a catch. The same reconciliation bill that boosts NASA’s budget also locks in four more years of funding for the government-built Space Launch System rocket—about $4.1 billion through 2029—shielding it from the year‑to‑year budget fights that commercial programs still face. That creates a two‑tier landscape: traditional contractors on SLS enjoy stable, protected revenue, while commercial launch and station providers live with the risk that Congress could trim their lines in any given budget cycle.

Analysts warn that this “bifurcated” funding model could actually slow the commercial transition NASA says it wants, because companies cannot safely plan multi‑year hardware investments around revenue that might disappear with a single appropriations bill. As a result, many space infrastructure investors increasingly treat NASA as an important but unreliable baseline customer, and push providers to build business models that lean more heavily on international partners, research firms, and private astronauts.

The next 12 to 18 months will show whether this commercial‑first strategy truly takes hold. Key tests include NASA’s selection of new station partners, a string of lunar lander flights, and the agency’s 2027 budget request, which will signal whether Congress intends to keep backing commercial space at today’s levels or let the experiment stall.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the In Depth tab. Other premium articles this week included an analysis of supply chain sovereignty in rare materials; a look at the strategic premium on supply chain gaps; and Redwire’s $925 million bet on Edge Autonomy.

Worth a Second Look:

Venture Capital Platform to be Launched at Florida Conference

Major Domestic Investment Secured by Gilmour Space

Alpha Block II Configuration Upgrade for Flight 8 Announced by Firefly

‘Innovate Space: Finance Forum’ Announced by Space Foundation

Space Force Awards $27 Million Contract to Slingshot Aerospace