The House Science, Space and Technology Committee took its first look at the NASA 2026 Reauthorization bill in a markup hearing this week.

“The NASA Reauthorization Act of 2026 ensures that America does not merely participate in the next year of space exploration, but that we lead it.”

Brian Babin (R-TX)

The full committee markup is the first opportunity for lawmakers to formally vote on the underlying bill, and offer amendments.

The bill brings a particular focus on the role the commercial space industry will play in future NASA missions. It explicitly empowers the NASA Administrator to enter into agreements and public–private partnerships with U.S. commercial providers to support human exploration of the Moon and cislunar space, expanding a model pioneered for cargo and crew to the International Space Station (ISS). The bill directs NASA to “support the development and demonstration of” human-rated lunar landing capabilities and, subject to funding, to procure those capabilities from “not fewer than two commercial providers,” effectively guaranteeing a multi‑vendor market for lunar landers and related services.

The legislation requires that any commercial provider supplying human lunar landing systems be a U.S. commercial provider, reinforcing a domestic industrial base for high‑end human‑spaceflight hardware and operations. By tying these systems directly to NASA’s Moon‑to‑Mars roadmap and Artemis missions, the bill signals steady demand for lunar transportation and surface operations that could anchor long‑term business plans in the commercial space sector.

Committee Chairman Brian Babin of Texas said that passing the reauthorization is essential to America’s future in space.

“The NASA Reauthorization Act of 2026 ensures that America does not merely participate in the next year of space exploration, but that we lead it. It strengthens our commitment to returning astronauts to the moon and building the capabilities needed to send humans onward to Mars,” Babin said. “It supports the systems, the technologies, and partnerships required for deep space missions, while also fueling a growing commercial economy and low Earth orbit that will sustain American leadership for many decades. With China nipping at our heels and investing heavily in its own ambitions beyond Earth, we cannot afford to drift without direction. This legislation ensures the United States sets the pace, establishes the standards, and carries forward the spirit of exploration that has long defined our nation.”

The bill positions commercial space stations and other private platforms as the backbone of U.S. low‑Earth orbit operations once the ISS is retired, directing NASA to spell out its research, development, and operational requirements in orbit and share them with U.S. industry.

Another section orders a report on the risks of any gap in U.S. access to low‑Earth orbit platforms, including the potential impact on “the development of the United States-based commercial space industry,” and explicitly lists “increasing investment in and accelerating development of commercial space stations” as one option to prevent such a gap. By writing commercial platforms into the strategy for replacing the ISS, the bill effectively treats private space stations as critical national infrastructure and a central pillar of the future orbital economy.

While the bill aims to expand commercial roles, it also tightens guardrails by requiring NASA to certify compliance with existing “commercial item” and competition statutes. Collectively, the provisions would entrench commercial companies as indispensable partners in NASA’s exploration, ISS transition, and low‑Earth orbit strategies.

-0-

Blue Origin will pause its New Shepard flights for at least two years, and shift resources to further accelerate development of the company’s human lunar capabilities, the company announced late last week. Blue Origin says the decision reflects its commitment to the nation’s goal of returning to the Moon and establishing a permanent, sustained lunar presence.

New Shepard has flown 38 times and carried 98 humans above the Kármán line to date. New Shepard has also launched more than 200 scientific and research payloads from students, academia, research organizations, and NASA.

Blue Origin’s larger rocket, New Glenn, is slated to fly for the third time in late February, though a launch window has not been announced. That flight is scheduled to deploy the BlueBird 7 communications satellite for AST SpaceMobile.

-0-

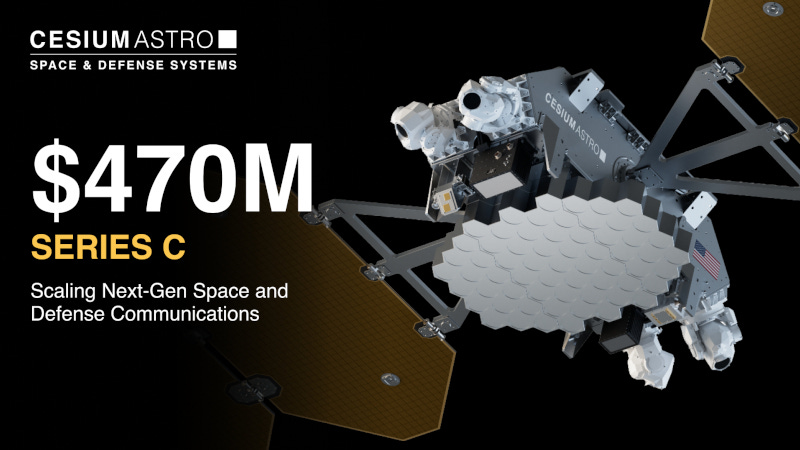

A Series C funding round has resulted in a $470 million growth capital raise for CesiumAstro, which the company says cements its position as a mission-critical provider of next-generation space and defense communications. The funding includes $270 million in equity, led by Trousdale Ventures.

The capital will fuel CesiumAstro’s rapid scale-up, including the build-out of a new 270,000-square-foot headquarters, expanded manufacturing capacity, and accelerated deployment of its software-defined, AI-enabled space communications platforms worldwide.

The funding comes amid strong operational execution, as CesiumAstro advances multiple government and commercial programs and expands its portfolio of software-defined communications systems.

Proceeds will support expanded manufacturing, accelerated AI-enabled communications development, scaled production of the company’s fully integrated Element LEO satellite, and growth of global technical and program teams.

A mission order for the fifth private astronaut mission (PAM) to the International Space Station has been signed by NASA and Axiom Space, the fifth consecutive such award granted by the agency.

Axiom Mission 5 (Ax-5) is targeted to launch no earlier than January 2027 from NASA’s Kennedy Space Center in Florida and is expected to spend up to 14 days docked to the space station. The crew complement is pending final agreements and agency and international approvals and will be announced at a future date.

As part of the NASA award, Axiom Space brings on Voyager Technologies as a teammate participating in payload integration.

In four years, Axiom Space has successfully executed four missions onboard the space station, flying 14 private and government astronauts, who conducted more than 160 science and research activities, and more than 100 outreach and media engagements while on orbit.

-0-

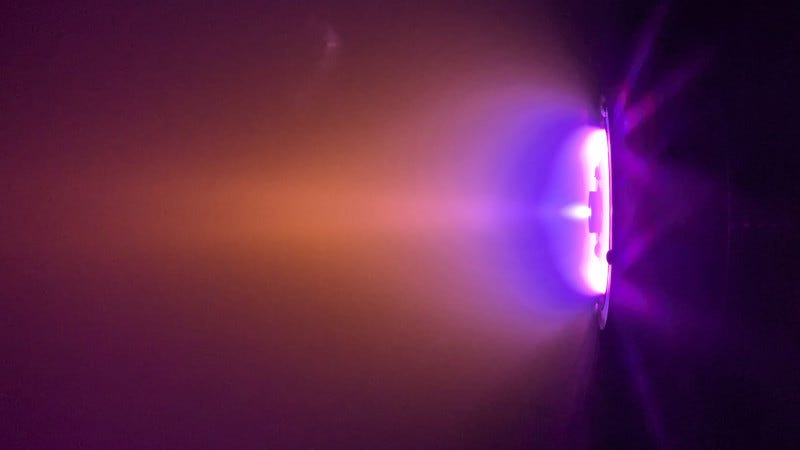

The satellite propulsion market, which encompasses propulsion systems that enable satellites to maintain orbit, change trajectories, control orientation, prevent collisions, or deorbit at mission end, is on track for significant expansion over the coming decade. Stratview Research projects that the market will grow from $3.08 billion in 2024 to $7.82 billion by 2032, achieving a CAGR of 12.3 % during the forecast period (2025-2032).

The single most important growth driver is the expansion in satellite launches for communication and Earth observation services, as the proliferation of satellites-which require reliable and efficient propulsion for accurate orbital placement and station-keeping-boosts demand across commercial, government, and defense sectors.

The electric propulsion segment is expected to be the fastest-growing segment through 2032, propelled by its efficiency, extended mission durations, and lower propellant requirements compared to chemical systems. As satellite platforms-particularly small and medium satellites-prioritize weight and performance, manufacturers and developers are increasingly investing in electric propulsion technologies that support longer operational life and reduced mission costs.

Market drivers include an increasing number of satellite launches for communication and Earth observation services; the rising adoption of efficient electric propulsion systems for extended mission life and reduced propellant needs, and; growth in commercial space activities driving demand for satellite propulsion innovations.

-0-

A stark divide is reshaping the space industry—and it comes down to a decision made back in late 2022.

In Depth this week, the industry split between adaptive commercial operators and constrained government programs. (Paywall)

When pandemic-era supply shortages hit satellite manufacturers, they faced a choice: wait for supply chains to recover, or rebuild them from scratch. Four years later, the companies that chose to rebuild are deploying satellite constellations on schedule. The ones that waited? They’re still waiting.

This isn’t just about pandemic recovery. An analysis published this week shows the space industry has fundamentally restructured into two tiers—where organizational agility matters more than component availability for well-funded operators, while material constraints continue to strangle everyone else.

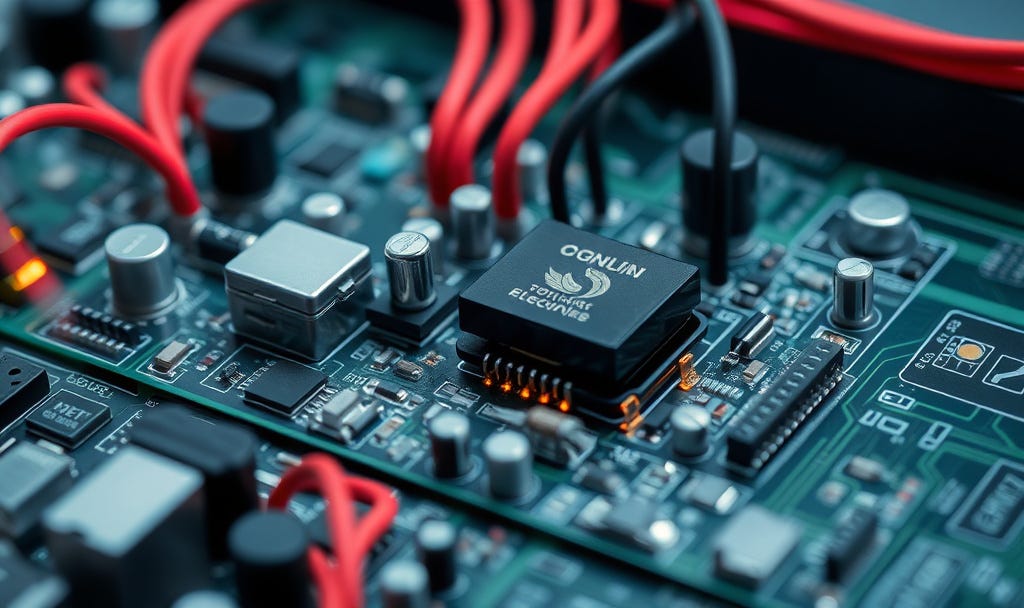

Back in mid-2022, the crisis was severe. Semiconductor lead times stretched to 40 to 52 weeks—triple the pre-pandemic baseline. Optical terminals for satellites required 18 months. Radiation-hardened processors? Also 18 months. As one production manager told Via Satellite: “After COVID, there are no more miracles.”

Fast forward to 2026, and some constraints have actually worsened. Rare earth elements, critical for satellite control systems, still face 12 to 18 month delays. China controls up to 93 percent of global rare earth processing. Heat pipe manufacturers can produce 200 to 300 units annually, but constellation demand sits at 600 to 1,000 units. The math simply doesn’t work.

So how are some companies succeeding? Vertical integration. SpaceX, for example, now manufactures roughly 85 percent of its components in-house—from engines to satellite systems. The result? 62 Starlink launches in just the first half of 2025.

But this strategy requires massive capital most companies lack. And it doesn’t solve the geology problem—dysprosium deposits concentrate in China, and no amount of in-house manufacturing changes that reality.

Government programs face additional constraints. Procurement regulations prevent the rapid supplier switching that commercial operators employ. The Space Development Agency experienced 6 to 8 month delays on its Tranche 1 constellation, partially due to propulsion supply chain issues.

Meanwhile, China has commissioned 37 satellite manufacturing plants, with more under construction—creating competitive pressure through sheer manufacturing scale.

The analysis concludes that organizational structure now determines competitive positioning as much as technology capability. Market consolidation appears inevitable, with only vertically-integrated players able to maintain schedule reliability. For the rest of the industry, the constraints persist.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the Supply Chain tab, where you can also find a report on how power system supply chains are constraining the mega-constellation era.

Worth a Second Look

SpaceX Acquires xAI to Build Space-Based AI Data Centers

W-5 Mission Reentry Brings Varda Spacecraft Back to Earth

Partnership Aims to Advance How Data Moves on Satellites

LeoLabs Closed 2025 With $60 Million in Total Contract Awards