Entrepreneur Jarad Isaacman has been confirmed as the next Administrator of NASA. The U.S. Senate on Wednesday voted 67-30 in favor of the nomination.

Isaacman was first nominated for the job by President Donald Trump in December, 2024, and he appeared to be headed for an easy confirmation. But that was derailed when the nomination was abruptly withdrawn in late May while the confirmation process was underway.

Trump re-nominated Isaacman in November, and facing little if any opposition in the Senate, his confirmation is now official.

-0-

The Florida state budget for FY26 proposed by Governor Ron DeSantis underscores his stated commitment to strengthening Florida’s aerospace sector as it enters a new era of growth. The Governor’s FY26 budget recommendations for Space Florida include $17.5 million in the operating budget and a total of $21 million for strategic, substantive aerospace project investments.

Space Florida is a public corporation and innovation connector created by the legislature to facilitate creative financing options and infrastructure access to space companies to the state.

The Governor’s budget recommendations for FY26 include investments designed to accelerate industry advancement, modernize and expand space transportation infrastructure, and ensure Florida remains competitive in an increasingly dynamic global space marketplace.

In addition to providing over $93 million through the FDOT Spaceport Improvement Program, the Fiscal Year 2026-27 Budget recommends $10 million to engage the Aerospace Investment Fund in maximizing growth in Florida’s statewide space strategy alongside commercial investments.

The space industry in Florida generates more than $9 billion in economic impact potential across all private sector aerospace projects.

The state legislature must approve the budget during its annual session early next year, and all of that funding is not guaranteed to make it through the legislative process.

-0-

Speaking of Space Florida, the agency, in conjunction with Seraphim Space, has launched the SpaceTech Investor Readiness Program, a partnership designed to accelerate innovation and investment across Florida’s growing SpaceTech ecosystem.

Seraphim has a portfolio of 148 companies across 32 countries, including five unicorns, that have collectively raised over $8.2 billion in funding. Seraphim and Space Florida will help connect Florida-based startups with investors and key partners to drive growth and investment readiness.

The pilot program brings experienced investors together with seven high-potential Florida-based SpaceTech startups, helping them become investment-ready, while connecting them to Seraphim’s global investor network, strategic corporate partners, and the broader Florida space ecosystem. The program also educates local investors on opportunities within the state’s growing SpaceTech sector.

The pilot will culminate with a showcase at SpaceCom Orlando in January, highlighting the companies and the program’s impact on Florida’s innovation landscape.

-0-

When Rocket Lab launched the “Raise and Shine” mission December 15, it carried a demonstration of orbital debris mitigation technology developed by Axelspace. D-SAIL is a deorbiting device designed to shorten the time a satellite remains in orbit after the termination of its operation.

The demonstration is part of a JAXA program named ‘Innovative Satellite Technology Demonstration-4’. The D-SAIL demonstration on the RApid Innovative payload demonstration SatellitE-4 (RAISE-4) mission is scheduled to begin in late 2026, about a year after launch. This will mark the first time that D-SAIL is operated in orbit.

The D-SAIL membrane deploys to increase atmospheric drag, gradually reducing the satellite’s altitude and eventually causing the spacecraft to enter the atmosphere.

This year, the FCC enacted rules requiring operators to dispose of their LEO satellites within five years of completing their missions, in a effort to mitigate the accumulation of space debris.

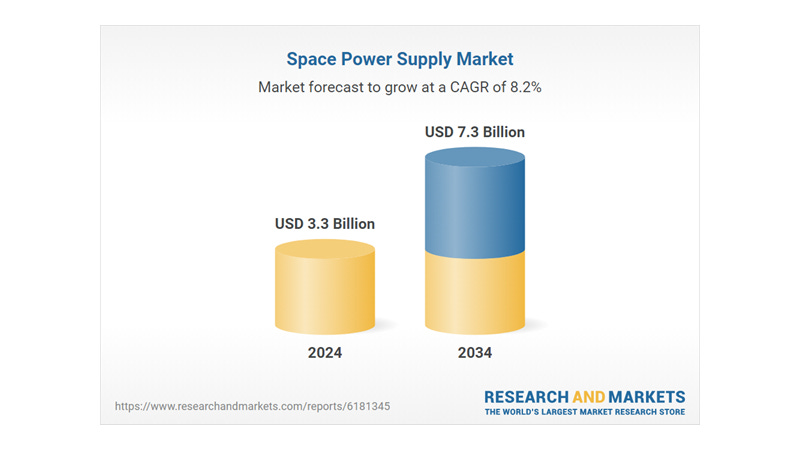

The Global Space Power Supply Market was valued at $3.3 billion in 2024 and is estimated to grow to $7.3 billion by 2034 at a CAGR of 8.2%, according to a new report from Global Market Insights.

The market growth is propelled by increasing satellite launches, improvements in photovoltaic technologies, rising demand for CubeSats and small satellites, and the growing push toward sustainability. The acceleration of commercial missions and the demand for efficient power systems to support various types of satellite operations continue to create long-term opportunities. Rapid satellite deployment, especially in the form of large constellations for communication, earth monitoring, and navigation applications, adds to the demand.

North America leads the global landscape due to its advanced aerospace ecosystem, substantial funding support, cutting-edge research investments, and early adoption of AI in national defense infrastructure. The market is also gaining from strategic collaborations between public agencies and private space technology developers.

The low power segment accounted for $939.8 million in 2024. This category thrives due to its compatibility with compact satellites and short-term missions. The solar power systems segment reached $2 billion in 2024. This growth is linked to the rising use of clean energy sources, maturing photovoltaic technologies, and the advantage of uninterrupted solar exposure in space.

-0-

Investments in three frontier technology companies that are positioned at the center of what could be a fundamental shift in how America builds, powers, and operates critical infrastructure beyond Earth’s surface have been announced by Balerion Space Ventures.

The investments in Antares Industries, Samara Aerospace, and Valar Atomics signal the intensifying convergence of space, defense, and industrial-scale energy systems, sectors that are increasingly recognized as foundational to U.S. competitiveness and national security.

Balerion’s investment will support product development, facility expansion, and key commercial milestone achievements as each company deepens engagement with defense, civil, and commercial customers.

-0-

Imagine this: When SpaceX launched the Transporter-15 mission, it carried 140 payloads from over 30 customers in 16 countries onto a single Falcon 9. Some satellites even hosted payloads from other companies. It’s rideshares carrying rideshares—sharing all the way down.

In depth this week: Welcome to the sharing economy in space (paywall). The old model—build your own satellite, buy your own launch, and operate your own ground stations—is quietly dying.

The hosted payload market reached $2.1 billion in 2024, and is projected to hit $6.8 billion by 2033. Mega-constellations are rapidly expanding, and are forecast to account for $4.27 billion toward $27.3 billion in market share by 2032. The economics are simple. Why pay $50 to $150 million for a dedicated launch when you can rideshare a 440-pound satellite for a few million? Why build global ground networks when Leaf Space, KSAT, or Atlas sell contact time by the minute? And why design custom buses when EnduroSat or K2 Space offer standardized platforms?

SpaceX’s Transporter program has launched over 1,000 smallsats since 2021. Transporter-15 showcased the maturity of the concept, deploying dozens of satellites, including CubeSats, tech demos, and orbital transfer vehicles, to custom orbits.

Orbital tugs like D-Orbit’s ION and Momentus’ Vigoride solve rideshare’s big limit: everyone starts in the same orbit. They deliver satellites precisely, like catching an Uber after the bus. K2 Space’s Mega platforms raise massive payloads from LEO to MEO fast and efficiently.

Ground Segment as a Service turns capex into opex—pay only for passes used, with reliable networks handling thousands monthly.

The demand is only expected to continue to grow. SpaceX does launch its own satellites on its own rockets, and Rocket Lab builds both rockets and satellites. But that company also has a solid business case for dedicated and rideshare missions. But most operators of satellite constellations depend on commercial launch operators to carry their payloads to orbit. Many use SpaceX, Amazon Leo, previously Project Kuiper, is riding to orbit aboard ULA launch vehicles, and Blue Origin’s New Glenn reusable heavy lift rocket could also become a SpaceX competitor for rideshare missions.

North America leads today, but Asia Pacific is catching up fast. By orbit, LEO dominates for lower latency and costs for applications like satellite-delivered Internet, as well as voice and video connectivity.

Do tradeoffs exist? Of course they do. Booking a rideshare mission means less schedule control, orbital compromises without tugs, potential ground access constraints, and security risks for sensitive missions.

Yet for most operators, sharing wins—slashing costs and accelerating access. It’s democratizing access to space, though increasing orbital congestion emphasizes the need for better traffic management.

So, like software two decades ago, the satellite industry is embracing shared infrastructure for routine missions. Dedicated systems remain for the edges—but the future is shared.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the Market Insights tab. And while you’re there, check out our in-depth reports coming regulatory changes for the commercial space industry, and the future for orbital data centers.

And that is Space Commerce Week for Sunday, December 21. We’ll be away for the Christmas and New Year’s break, but Space Commerce Week will return on January 11. Have a great holiday season.

Worth a Second Look

Wireless Power Receiver Added to Blue Ghost Moon Lander

Starfighters Space Begins Initial Public Offering

Canadian Space Agency Awards R&D Funding to Rocket Lab

Partnership Aims to Expand Access to Natural Catastrophe Solutions

Commercial Space Policy at a Crossroads (Paywall)