SpaceX has filed an application with the Federal Communications Commission seeking approval to launch up to one million satellites for what the company is calling an orbital data center system.

To put that number in perspective, that’s roughly a thousand times larger than SpaceX’s current Starlink internet constellation. The FCC’s Space Bureau accepted the application last week, setting the wheels in motion for what could become an unprecedented expansion of commercial space operations.

According to the filing, these satellites would operate at altitudes between 310 and 1,243 miles above Earth, organized in orbital shells spanning up to 30 miles each. The system would rely primarily on high-bandwidth optical links to communicate between satellites and connect with the existing Starlink network.

What’s particularly interesting here is the timing. This filing comes on the heels of SpaceX’s acquisition of xAI, Elon Musk’s artificial intelligence company. In the application, SpaceX characterizes this orbital data center system as the first step toward becoming what’s called a Kardashev Type Two civilization—that’s a theoretical framework describing a civilization advanced enough to harness the full power of its host star.

SpaceX has requested several waivers from standard FCC regulations, including exemptions from typical deployment milestones and surety bond requirements. The commission has set March 6 as the deadline for public comments on the application.

If approved, this would represent a fundamental shift in how we think about computing infrastructure—moving massive data processing capabilities off Earth and into orbit.

-0-

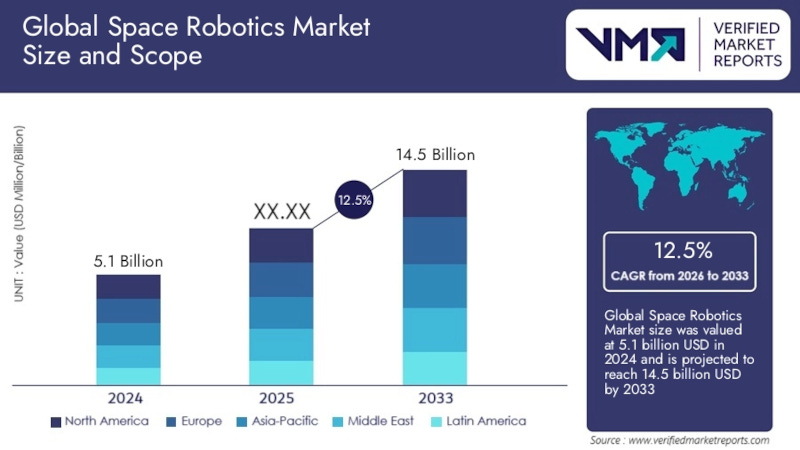

According to a new report from Verified Market Reports, the space robotics sector is positioned for robust expansion over the next decade. The market, valued at 5.1 billion dollars in 2024, is expected to reach 14.5 billion dollars by 2033—that’s a compound annual growth rate of 12.5 percent.

The drivers behind this growth are multifaceted. There’s accelerating demand for on-orbit servicing, satellite life extension, debris mitigation, and planetary exploration. But what’s really changing the game are advances in autonomy and artificial intelligence.

The report highlights how robotic systems are transitioning from government-led experimentation to commercially scalable deployment. We’re seeing robots designed for satellite servicing, refueling, inspection, and in-space assembly becoming integral to cost-optimization strategies for satellite operators. This directly supports longer satellite lifecycles, reduced launch frequency, and improved return on space infrastructure investments.

Artificial intelligence and machine learning are redefining what’s operationally possible. Autonomous navigation, fault detection, and adaptive manipulation allow space robots to operate with minimal human intervention. This is crucial for mitigating communication latency and enabling deep-space and cislunar missions.

The growth isn’t limited to commercial applications either. Space robotics is emerging as a core enabler for defense applications—satellite inspection, threat monitoring, and orbital asset protection. Governments worldwide are prioritizing resilient and responsive space infrastructure, creating sustained demand for robotic platforms.

Looking ahead, robotic systems are foundational to lunar and Martian exploration strategies. They enable surface mobility, regolith handling, construction, and scientific experimentation while reducing human risk and establishing infrastructure for future crewed missions.

Despite the momentum, challenges remain. High upfront development costs, technical complexity, regulatory uncertainty, and mission risk continue to present obstacles. However, the industry is addressing these through modular design architectures, digital twins, and simulation-driven development. Public-private partnerships are also playing a critical role by sharing financial risk and accelerating validation through government-sponsored missions.

-0-

Voyager Technologies and Max Space have announced a collaboration to advance expandable space habitat technology. This partnership brings together Voyager’s experience delivering mission-critical space systems with Max Space’s high-volume, low-mass expandable structure technology.

According to Voyager chairman and CEO Dylan Taylor, the Moon is no longer viewed as a single destination or a symbolic achievement. It’s becoming the next operational domain in a growing space economy that spans exploration, science, national security, and commercial development.

What makes expandable structures so significant? They offer a step change in how surface infrastructure can be delivered and deployed. Max Space’s technology is built on 40 years of on-orbit heritage and represents what the company says is a significant improvement over previous generations.

The development path is phased and methodical. Ground validation and in-space demonstrations are planned for later this decade, with operational lunar and Mars capabilities aligned with NASA’s exploration timelines on the horizon. The partnership emphasizes early risk retirement, interoperability, and commercial scalability as guiding principles.

This collaboration reflects a broader trend in the space industry—moving from short-duration missions to sustained operational presence beyond low Earth orbit. As the space economy expands, infrastructure designed for endurance and industrial-scale execution becomes increasingly important.

Subscribe

NASA’s Space Technology Mission Directorate is inviting public feedback on its prioritization of technology shortfalls critical to civil space. The deadline for input is February 20, so if you’re listening to this and have expertise in the field, there’s still time to participate.

NASA has identified 32 technology shortfalls—these are technology areas requiring further development to meet future exploration, science, and mission needs. Each shortfall includes a subset of specific functions that must be achieved to overcome that particular challenge.

This represents a streamlined approach compared to NASA’s 2024 effort, which featured 187 shortfalls. The agency consolidated these into broader, integrated categories based on stakeholder feedback, making the process more efficient and accessible.

Why does this matter? This prioritization framework will guide NASA’s evaluation of current technology development efforts and may inspire new investments within the agency or spark innovative partnerships. Understanding and prioritizing the most impactful efforts allows NASA to appropriately direct available resources to best support mission needs.

The Space Technology Mission Directorate’s investment strategy is comprehensive. It aligns with the current Presidential Administration’s priorities and NASA’s Moon to Mars strategy. It focuses on science priorities identified in the Decadal Surveys. It fosters creation and growth of the space economy through industry partnerships and small business innovation.

NASA is encouraging all U.S. businesses, organizations, agencies, and individuals with a vested interest in space technology to review the shortfall list and submit feedback. This collaborative approach to identifying and addressing technology gaps represents a best practice in government-industry partnership.

The results will inform not just immediate investment decisions but also the development of long-term technology roadmaps.

-0-

NASA and Momentus have signed a Space Act Agreement for a mission demonstrating rendezvous and proximity operations, as well as formation flying in low Earth orbit. At the center of this mission is NASA’s R5 Spacecraft 10, which will act as a free-flying imager for Momentus’ Vigoride 7 Orbital Service Vehicle.

The R5-S10 will assess spacecraft health and performance, marking a critical step in refining In-Space Assembly and Manufacturing capabilities—essential for future autonomous space operations. The mission is funded and managed by NASA’s Small Spacecraft Technology program and the Engineering Directorate at Johnson Space Center.

There’s an additional military dimension to this mission. NASA is supporting Momentus in executing a rendezvous demonstration for the Air Force Research Lab’s SPACEWERX organization. The Low-Cost Multispectral Rendezvous and Proximity Operations Sensor suite will enhance spacecraft situational awareness and relative navigation—critical capabilities for satellite servicing and space debris management.

The mission will also demonstrate inter-satellite link technology using WiFi-based data transmission. The CubeSat will transfer large files to the Vigoride host platform, which will then downlink them to ground stations. This demonstrates the viability of real-time space communication for future missions.

Vigoride 7 is scheduled for launch no earlier than March 2026 aboard a SpaceX Transporter mission.

-0-

In Depth this week ... the dream of space tourism is hitting turbulence. Just weeks ago, Blue Origin announced it’s grounding its New Shepard tourist flights for at least two years, marking a dramatic shift in an industry that once promised exponential growth. (Paywall)

The pause comes on the heels of Virgin Galactic’s suspension of operations back in June 2024. That means the suborbital space tourism market—the more affordable option for space travel—is effectively dormant through at least 2027.

So what happened? Industry analysts say the business model simply didn’t work. Despite ticket prices of up to $600,000, companies couldn’t turn a profit. Vehicles required weeks of refurbishment between flights. The rapid reusability that makes SpaceX profitable never materialized for suborbital tourism.

And demand fell short of projections. The initial wave of celebrity millionaires proved finite, and there wasn’t a second wave waiting. The gulf between $600,000 tickets and what middle-class space enthusiasts could afford—somewhere between $10,000 and $50,000—remains unbridgeable.

Meanwhile, orbital tourism is thriving. SpaceX and Axiom Space continue flying paying customers to the International Space Station at $55 million per seat. Paradoxically, this ultra-premium model proves more sustainable because expectations align with reality: a tiny market of ultra-wealthy individuals seeking transformative experiences.

Market forecasts have been slashed dramatically. Original projections of up to $10 billion by 2030 have been revised down to $2 to $4 billion. The vision of “space for everyone” is being pushed further into the 2030s.

For now, space tourism remains what it has always been: an exclusive experience for the ultra-wealthy, with orbital flights as its most viable expression. The democratization of space will have to wait.

Paid subscribers can read the full article on The Journal of Space Commerce under the Market Insights tab, where you can also find a deep dive on how space insurance brokers engineer risk. You can also check out our article on the microchip bottleneck under the Supply Chain tab.

Worth Another Look

Space Florida Announces 2026 Call for Projects

NASA STTR Project to Advance Lunar Trenching and Excavation Technology

Initiative Aimed at Increasing the Resilience of PNT Systems

Sixth Patent Awarded for Bishop Airlock

Paying for Permission: The Business Case for Buying Legal Certainty in Space Mining (Paywall)