Sidus Space reported a net loss of $6 million in the third quarter as it advances its strategic transition toward higher-value commercial operations. The aerospace company reported third-quarter revenue of $1.3 million, down 31 percent from $1.9 million in the same period last year. The decline reflects a strategic shift away from lower-margin legacy services toward higher-value commercial technology platforms.

Sidus attributed cost increases to satellite and software depreciation, along with higher material and labor expenses. The company is investing in its LizzieSat satellite constellation, Fortis VPX computing platform, and other defense technology systems while trimming administrative spending.

On an earnings call reporting the company’s third quarter financials, Sidus CEO Carol Craig said the company is looking forward while servicing existing contracts.

“Q3 was about executing on existing contracts and furthering our efforts to expand our vertically integrated product offerings,” Craig said. “We remain focused on disciplined execution by aligning spend to near-term revenue milestones, identifying operational efficiencies in the form of expense reductions, strengthening our intellectual property, expanding our global partnerships, and accelerating our path to commercialization across space and defense markets as we close out the year.”

According to the quarterly report, Sidus’ cash reserves totaled $12.7 million at September 30, compared with $15.7 million a year earlier. Sidus reported adjusted EBITDA losses of $4 million, versus $2.5 million in third quarter 2024.

-0-

Meanwhile, the company held a kickoff meeting and System Requirements Review (SRR) for the Commercial Pathfinder mission it is planning with Lonestar Data Holdings, marking rapid advancement toward full mission execution with initial payment received.

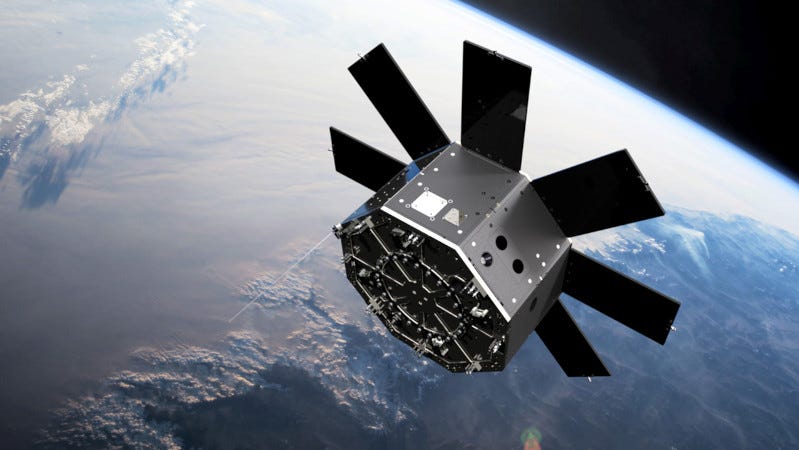

These achievements are part of the contract supporting Lonestar’s Commercial Pathfinder Mission to validate its advanced in-space data storage solution. This solution includes secure data uplink, long-term data storage, rapid onboard AI-driven processing via FeatherEdge, which is the Sidus Space edge computer and on-demand downlink of critical data directly from orbit.

Sidus is contracted to design, develop, test, and integrate Lonestar’s Data Storage Module into its next LizzieSat launch as one of several hosted payloads, and will provide post-launch commissioning. Data transmission and storage will be priced separately as a recurring data-as-a-service contract.

-0-

The Dream Chaser spaceplane, under development by Sierra Space, has successfully completed a series of critical pre-flight tests at NASA’s Kennedy Space Center (KSC), marking continued progress toward Dream Chaser’s first free-flyer mission.

As part of its comprehensive testing campaign, Dream Chaser underwent Electromagnetic Interference and Electromagnetic Compatibility (EMI/EMC) testing at NASA’s Space Systems Processing Facility (SSPF). These tests verified the spacecraft’s ability to operate within expected electromagnetic environments throughout various missions.

The spacecraft also completed rigorous tow testing at KSC and Space Florida’s Launch and Landing Facility. For this phase, a Freightliner Cascadia truck, provided by Daimler Truck North America, towed the spaceplane at high speeds to simulate critical dynamics and validating autonomous navigational parameters during runway landing operations.

The spacecraft’s ability to receive telemetry and distribute commands between the spacecraft and Mission Control in Louisville, Colorado over NASA’s Tracking and Data Relay Satellite System network has been demonstrated, and the testing campaign concluded with a post landing recovery rehearsal, which demonstrated the safing of vehicle systems and timely access to sensitive payloads.

Dream Chaser is on track for its first launch to Low Earth Orbit, targeted in Q4 of 2026, through a demonstration mission under the CRS-2 contract with a runway landing at Vandenberg Space Force Base.

-0-

Coming up, a new name for Project Kuiper. But right now, why not take a minute to become a paid subscriber to The Journal of Space Commerce. Whether you’re a space professional, an investor or enthusiast, paid subscribers have first access to premium articles and podcasts focused on the new space economy. Just visit www.exterrajsc.com on Substack, and help keep The Journal of Space Commerce independent as we chronicle, cajole and, when necessary, critique the commercial space industry.

Amazon has rebranded its Low Earth Orbit (LEO) satellite Internet program as Amazon Leo. Previously Project Kuiper, the company says the change is a simple nod to the low Earth orbit satellite constellation that powers the network.

In an article posted on the Amazon website, Rajeev Badyal, vice president of Amazon Leo said that “Project Kuiper” was a code name inspired by the Kuiper Belt, a ring of asteroids in our outer solar system. The code name remained associated with the program through many of its early milestones: filing and receiving initial licenses, signing the largest set of launch contracts in history, completing a successful prototype mission, and deploying the first full batch of production satellites earlier this year.

Amazon Leo will become the permanent name for the brand, but Badyal said the long-term mission remains the same.

-0-

Space domain awareness is a real and growing issue among spacefaring nations and companies. With the tens of thousands of objects in Earth orbit, keeping track of everything circling the planet is becoming a big business.

But occasionally, things get lost. That was the case in September, when, shortly after launch, Russia’s Mozhayets-6 went dark. It was literally lost in space.

For five weeks.

The company that found the missing satellite was Slingshot Aerospace, and joining me now is Belinda Marchand, Chief Science Officer at Slingshot. How did Slingshot get involved in finding the wayward satellite?

Belinda Marchand, Slingshot Aerospace

We started to, look at this as an opportunity to say, hey, here’s a challenge. Let’s see, you know, how can we go about finding this object, right? What are the things that we need to do to find this object? And so that kind of kicked it off, right? It was a combination of clearly there’s no information on it. It’s in the catalog in the sense that we know it’s been launched, right? What we don’t know is what orbit it’s in or where it is. And even today, when you log on to spacetrack.org, it’s still not there. You know it’s listed in the sense that it’s been launched, but there’s no orbital information on it. On why its counterpart?

Ex Terra Media

So what did you do? Because I understood that there was a, there was something about a post on X that kind of puts you onto the track of where the satellite was.

Belinda Marchand, Slingshot Aerospace

Yeah. So once we decided to explore a path to locate the object, we started just doing a little bit of sleuthing, right? What information can we find out there that may be known about this object that can help us narrow down our search? Some of that information initially came from our SARA data database, which told us this was a reasonably small object. And that then told us, it’s going to be dim. We can do some simulations to figure out what we expect our sensors will or will not be able to see. We still needed more information. So we kept looking around, and we came across, in a forum, we came across a post from S2A Systems. They didn’t identify it as that object at the time. They were tracking the GLONASS satellite that had just been launched. And there was a comment in the post about a dim object in the vicinity of the GLONASS satellite that seemed to be tumbling. And so it was in the course of doing the research a month later that we found this article that was dated a day after the GLONASS satellite had been launched. So on the 14th is when that post had gone up. And we suspected, based on the information from SERA data, that this dim object that they were seeing that was tumbling was in all likelihood this Moss-Hayat 6 satellite. And that kind of gave us confirmation of, okay, this seems to be in the right ballpark of an object. It confirms what SERA data says. It’s in a similar orbit to GLONASS. Because it’s small, it also would have limited maneuvering capabilities in terms of how quickly it can affect orbital changes, right? So a small satellite, for example, would take longer to change its orbital inclination, and it would be limited in how much of A change it could achieve, because its resources from a propulsion perspective are limited. And that meant Yes, the object was more than likely in a similar orbit to that GLONASS initial orbit after it was deployed. So that narrowed down the space, the search space for us. Okay, we’re looking for something small that is close to that initial orbital plane. of the GLONASS satellite and probably in some similar facing areas. So we just have to figure out how to do the scan of that orbital plane to locate that object and then use that predictive brightness information to help us identify the right systems that could track it. And that’s how it got started.

Ex Terra Media

Was the Russian government forthcoming about this? Did you have any interaction with them as far as Slingshot was concerned? Or did they just say, I’m sorry, we lost it?

Belinda Marchand, Slingshot Aerospace

No, we did not have any direct interaction with them. We found in our research, we came across screenshots from Russian social media posts, which then can be translated And from their perspective, the information that was being put out was that all satellites were successfully deployed and operating. And that’s the last we saw of it, right? But that was around the time of the launch, which was on 9-13. So we did not, at the time that we were looking, we did not identify any other information that had been released by Russia other than what was released around the lunchtime.

Ex Terra Media

Is this something that happens fairly commonly or is it a really rare occurrence that a satellite just suddenly goes dark and gets lost?

Belinda Marchand, Slingshot Aerospace

It’s not something that happens every day, but it does happen, right? Usually, and it can happen really at any point in the life of a satellite that some event causes it, some loss of function causes it to lose attitude control and begins tumbling. And oftentimes it happens after it’s been deployed from the launch vehicle. If you are, if something happens that prevents you from commissioning the satellite properly, you may not be able to recover it just for that reason. But there certainly are other events that could cause that as well. So you may actually have a satellite that in theory, could have most of its function still intact, and it’s just unable to recover from the tumble for some reason. But in this case, it seemed to happen shortly after launch.

Ex Terra Media

Anything else you’d like to add?

Belinda Marchand, Slingshot Aerospace

I think this is a great example of, you know, the value that government resources and commercial entities working together can bring to the SDA mission. Every sensor that supports space safety, security, and sustainability is value added. And this is a great example of 1 case where we were really well positioned to locate this object. And it is a service that we do provide as well to operators. Sometimes operators will have issues. both in the early orbit phase and sometimes during the lifetime of their satellites, and they need a little help relocating or recovering their assets or trying to figure out what happened, you know, what might be preventing them from communicating or executing their mission. And so being able to tap on resources like that, you know, space object tracking and other supporting functions related to that mission are very valuable.

Belinda Marchand is Chief Science Officer at Slingshot Aerospace

-0-

An agreement has been reached between SES and Infinite Orbits for one geostationary satellite life extension mission, marking the first commercial life extension mission in Europe. The mission will be carried out by Endurance, a 1,650 pound docking vehicle designed for life extension missions.

The launch of Endurance is currently planned for late 2027, and is expected to dock with one SES geostationary satellite following an in-orbit demonstration. This life-extension vehicle has been designed to offer Infinite Orbits’ clients a new generation of in-orbit services, including station keeping, pointing management, orbital relocation and end-of-life disposal.

-0-

In depth this week, Europe stands at a crossroads when it comes to satellite-based intelligence. But the closing of a €50 million Series A round by Reflex Aerospace in this month crystallized a strategic awakening defense ministers across the continent have been quietly confronting for years. Europe’s reliance on external providers for critical satellite intelligence has become what German Defense Minister Boris Pistorius (piss-TOR-EE-us) calls an “Achilles heel of modern societies,” and the rush to fix this vulnerability has the potential to reshape the entire European space economy.

Less than two months before Reflex’s announcement, Germany unveiled plans to invest approximately €35 billion in space-related defense projects through 2030, while the European Union confirmed it would launch its European Space Shield Initiative in 2026. This isn’t coincidental timing—it’s the manifestation of a strategic imperative that decades of European space policy left unaddressed.

The scope of Europe’s satellite intelligence deficit becomes clear when examining what military planners call ISR capabilities—Intelligence, Surveillance, and Reconnaissance functions that modern defense operations consider non-negotiable. While the United States operates hundreds of classified reconnaissance satellites and maintains sovereign control over critical geospatial data, European nations have historically relied on a patchwork of commercial providers, allied data-sharing agreements, and aging national systems that lack the speed and resilience required for contemporary threat environments.

Finnish satellite manufacturer ICEYE, which operates 54 SAR satellites—the largest commercial synthetic aperture radar constellation globally—has become Europe’s defense space-intelligence linchpin precisely because alternatives remain scarce. This concentration risk extends beyond operational concerns into geopolitical vulnerability, and the European Space Policy Institute’s October 2025 report explicitly called for Europe to “close the innovation gap in space” and develop sovereign alternatives that ensure uninterrupted access to ISR capabilities regardless of shifting international alliances.

Reflex Aerospace’s €50 million Series A unfolds against a backdrop of significant consolidation among European space incumbents. In October 2025, Airbus, Thales, and Leonardo signed a memorandum of understanding to merge their space divisions—a combination that would create a European space giant better positioned to compete with American and Chinese counterparts but that also concentrates capacity in fewer hands. The European Space Agency announced it would study the broad impact of this satellite merger, with ESA Director General Josef Aschbacher acknowledging that “mergers occur” while emphasizing the agency would consider implications in future procurement decisions.

Reflex Aerospace’s record Series A represents more than financing—it brings into sharp focus a fundamental shift in how European governments, investors, and industrial players approach space-based intelligence and strategic vulnerability. Walter Ballheimer’s declaration that “Europe cannot afford to remain reliant on external actors” articulates a consensus now driving billions in defense investment and reshaping the European space economy.

The company’s 2027 timeline for orbital demonstration provides a clear deadline. What remains to be seen is whether Europe’s emerging ecosystem of startups, institutional programs, and venture capital can close capability gaps before geopolitical circumstances make the consequences of dependency a reality.

Paid subscribers can read the full analysis on The Journal of Space Commerce under the ‘In Depth’ tab.

And those are some of the top stories we covered for you on The Journal of Space Commerce this week. Space Commerce Week is a production of Ex Terra Media. You can get daily updates on space commerce by subscribing to The Journal of Space Commerce on Substack at www.exterrajsc.com. And please consider becoming a paid subscriber. Whether you’re a space professional, an investor or enthusiast, paid subscribers have first access to premium articles and podcasts focused on the new space economy. Just visit www.exterrajsc.com and help keep The Journal of Space Commerce independent as we chronicle, cajole and, when necessary, critique the commercial space industry.

Worth a Second Look

Deep-Space Time Synchronization Vartis Space Clock Unveiled

Power Purchase Agreement Reached by Star Catcher, Loft Orbital

Eutelsat Takes First Step in a Comprehensive Financing Strategy

Theme Stock Music Provided by Pond 5