When Authorization Meets a Deal Wave

NASA’s Commercial Framework and the Two-Speed Space M&A Market

By late 2025, two curves started to cross in ways that matter for every serious space dealmaker: a more assertive NASA commercial authorization framework on one axis, and a sharp global rebound in mergers and acquisitions on the other. Global deal value is projected to hit around $4.8 trillion in 2025, up roughly a third from the prior year, with average EV/EBITDA multiples pushing into the mid-teens in some sectors, even as they remain below the 2021 peak. Within that surge, aerospace, defense, and space assets are seeing renewed attention as capital rotates back into hard infrastructure, critical supply chains, and strategically favored markets.

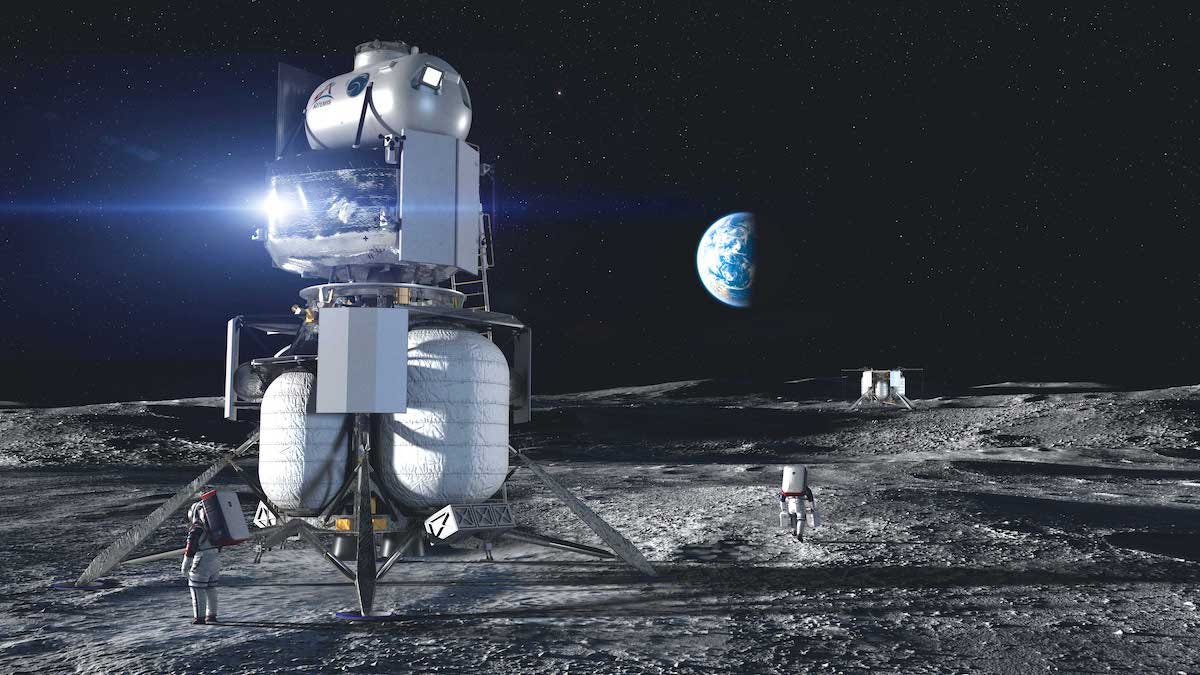

At the same time, Congress and the Trump administration have been working through a new NASA authorization framework and FY2026 budget posture that leans harder into commercial services in low Earth orbit, on and around the Moon, and in space-derived data. Draft authorization texts and committee summaries emphasize leveraging private capabilities, expanding commercial LEO destinations, and sustaining multi-provider approaches in lunar payload delivery and surface services. NASA’s own directives for the Commercial LEO Destinations effort stress that the program should support commercial viability while enabling an orderly transition away from the International Space Station, signaling that policy is being written with private balance sheets firmly in mind.

Put those trends together and you do not get a single, homogeneous space Merger and Acquisition (M&A) market. You get a two-speed landscape: one lane where assets tied to NASA-influenced, contract-backed cash flows and critical infrastructure are trading at disciplined but defensible valuation bands, and another where pure-play commercial platforms still command richer growth multiples that will only be validated if they can turn authorization-driven demand signals into durable, multi-customer revenue.

For C-suite teams, corporate development leads, and investors across the space value chain, the practical question is no longer whether NASA will work with commercial partners—it is how that relationship shows up in deal models, discount rates, and exit timelines.