The Rising Satellite Communication Market

Forecast Predicts Double-Digit Annual Growth over Five Years

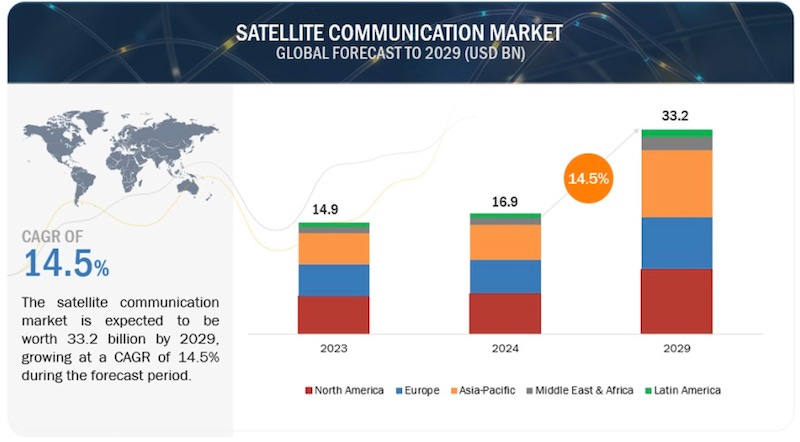

The global Satellite Communication Market size is projected to grow from $16.9 billion in 2024 to $33.2 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period, according to a new report by MarketsandMarkets.

Military and government agencies rely heavily on satellite communication to ensure secure, reliable, and uninte…