Space Semiconductors Market Insights 2025

Annual Growth Projected to be More Than Eight Percent

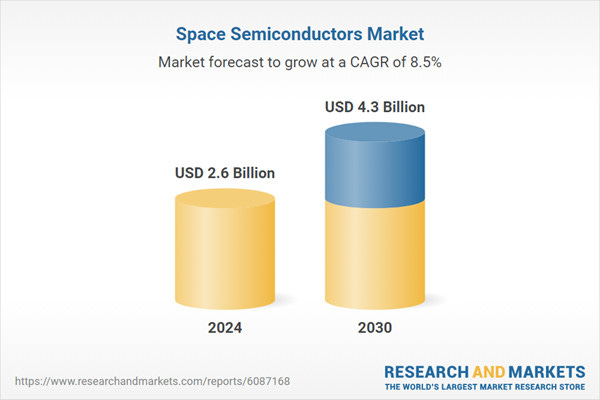

The global market for Space Semiconductors was valued at $2.6 billion in 2024 and is projected to reach $4.3 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030, according to a new report from Global Industry Analysts, Inc.

This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed…