Space Launch Services Market Revenue May Reach $57.94 Billion by 2033

Multiple Factors Fueling Rapid Growth, Report Says

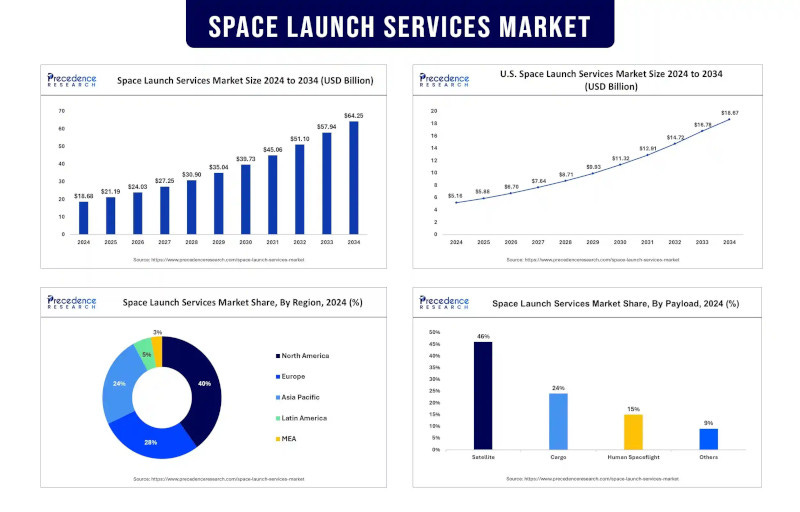

The space launch services market revenue reached $21.19 billion in 2025 and is predicted to attain around $57.94 billion by 2033 with a CAGR of 13.15%, according to a new report from Precedence Research. The market is witnessing rapid growth due to increasing demand for satellite deployment, expansion of commercial space enterprises, and heightened inve…