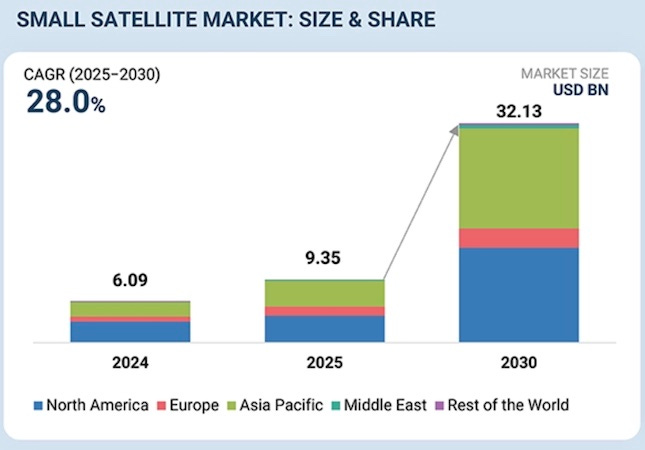

Small Satellite Market worth $32.13 billion by 2030: Report

Affordable, Frequent Launches Driving Market Growth

The Small Satellite Market is projected to grow from $9.35 billion in 2025 to $32.13 billion by 2030, with a CAGR of 28.0%, according to a new report from MarketsandMarkets. Increased demand for affordable space missions, more frequent launches, and expanded use in communications, Earth observation, and defense applications are all expected to contribute to the upswing.

One major factor is the expansion of LEO constellations for broadband and Earth observation. Increased government use of small satellites for ISR, PNT, and tactical communications is creating steady institutional demand. Additionally, falling manufacturing and launch costs are enabling shorter replacement cycles and more frequent satellite launches. The rising need for high-revisit data in downstream applications is further boosting the adoption of large, scalable small satellite constellations.

The Ku-band is the largest segment in the small satellite market, mainly because it is widely used for satellite communication by both commercial and government users. It offers a good balance of bandwidth coverage and terminal size, making it useful for broadband connectivity in maritime, aviation, and enterprise services. Many LEO and GEO constellations use Ku-band payloads, leading to high satellite volumes and steady demand. Additionally, the ground infrastructure for Ku-band is already well developed, and global regulations support its use, helping it maintain a dominant position in the small satellite market.

The fastest-growing segment in the small satellite market is the commercial sector, as more companies are using satellites for data and revenue-generating services. Commercial satellite operators, telecom firms, and service providers are deploying small satellite constellations to provide broadband connectivity, high-resolution Earth imagery, and continuous monitoring. Lower satellite and launch costs have reduced entry barriers, allowing private companies to quickly scale their constellations. Additionally, increasing demand from sectors such as energy, media, and research for real-time and high-frequency data is boosting commercial investment in small satellite systems.

The Asia Pacific region is exhibiting the fastest growth in the small satellite industry as more investment flows into satellite technology and space programs across China, India, Japan, South Korea, and Australia. Small satellites are now widely used for Earth observation, climate monitoring, agriculture planning, and border surveillance, supporting both government and commercial needs. There is also increasing demand for communication services like digital TV and direct-to-home broadcasting, which is driving more small satellite launches. Strong policy support and consistent launch activity across the region are helping the market grow rapidly.

SpaceX (US), Airbus Defence and Space (France), MDA Space (Canada), China Aerospace Science and Technology Corporation (China), and Thales Alenia Space (France) are the key players in the market due to their strong global distribution networks.