Executive Summary

Slingshot Aerospace has positioned itself as a specialized provider of space situational awareness solutions, focusing on satellite tracking, space traffic coordination, and modeling capabilities. According to its website, Slingshot provides solutions for satellite tracking, space traffic coordination and space modeling and simulations to make space safer, sustainable and secure. The company operates in the growing space traffic management sector, serving both government and commercial customers with data analytics and simulation platforms.

Company Overview and Mission

Founded in 2016 and headquartered in El Segundo, California, with additional operations in Austin, Texas, Slingshot Aerospace has established itself in the space data analytics market. According to LinkedIn, the company provides satellite tracking, space traffic coordination, and space modeling and simulation solutions to government and commercial customers around the world. The company's stated mission centers on making space operations safer, more sustainable, and secure through advanced analytics and simulation technologies.

Products and Technology Platform

Core Product Suite

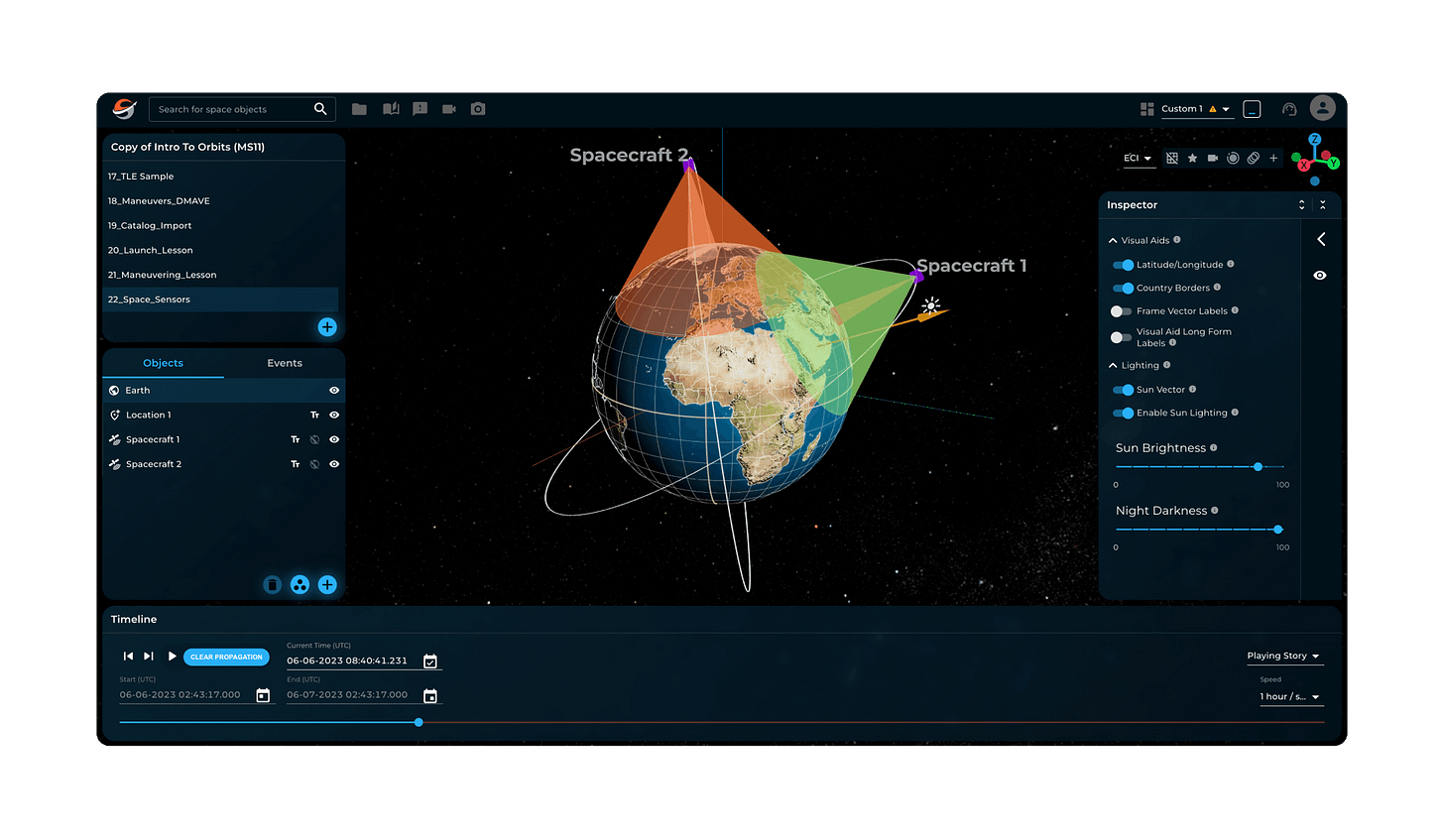

Slingshot's primary offering revolves around space situational awareness platforms that integrate various data sources to provide comprehensive space environment monitoring. According to the company's website, the world's leading space operators leverage Slingshot's solutions to understand what is happening in space and plan their operations with mission-critical data, insights, and applications.

Digital Space Twin Technology

The company's flagship innovation is its Digital Space Twin platform, which represents a virtual replica of the space environment. According to Business Wire, Slingshot announced the industry's first Digital Space Twin in March 2022. According to VentureBeat, Slingshot Aerospace has been developing its Digital Space Twin tool for the last two years and just landed a $25.2 million contract with the U.S. Space Force.