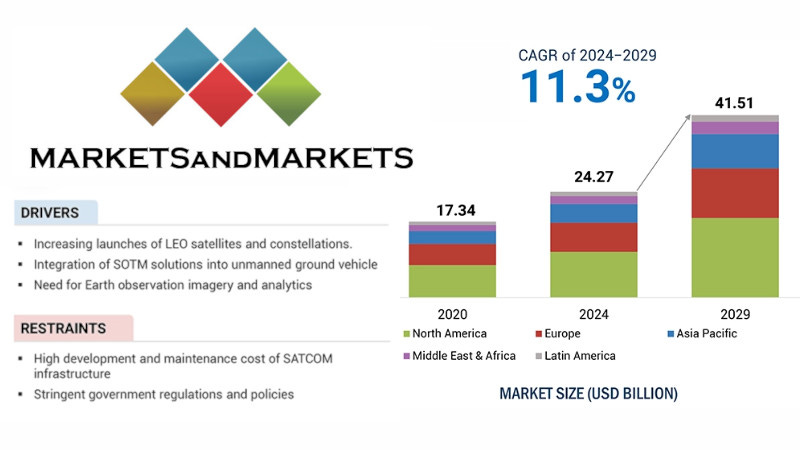

SATCOM Equipment Market Worth $41.51 Billion by 2029: Report

Encompasses Antennas, Transceivers, Modems, Power Amplifiers, and Integrated Systems

The SATCOM (Satellite Communications) equipment market, valued at $24.27 billion in 2024, is projected to reach $41.51 billion by 2029, at a CAGR of 11.3% from 2024 to 2029 according to a new report by MarketsandMarkets. The SATCOM equipment market is a rapidly evolving sector that has become integral to global communications, thanks to the use of satel…