Rapid Growth in Space Tourism Fueled by Commercial Space Travel: Report

Market Forecast to Reach Nearly $4 Billion by 2031

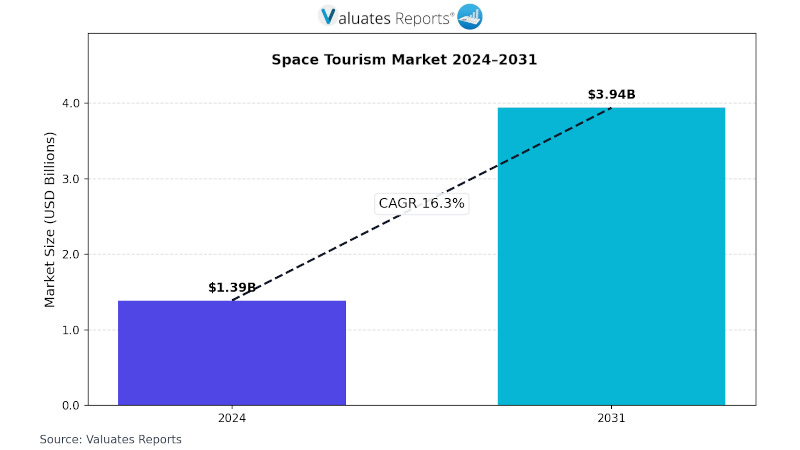

The global market for Space Tourism, which was estimated to be worth $1.4 billion in 2024, is forecast to a readjusted size of $3,9 billion by 2031 with a CAGR of 16.3% during the forecast period.

According to a new report from Valuates Reports, the space tourism market is experiencing unprecedented growth driven by technological breakthroughs, expanding private sector investments, and increasing consumer appetite for extraterrestrial experiences. Several catalytic forces are reshaping this nascent industry into a commercially viable sector:

Government space commercialization policies enabling private sector participation and streamlined licensing frameworks globally

Reusable rocket technology reducing launch costs and improving mission frequency capabilities significantly

Ultra-high-net-worth individuals seeking exclusive experiential luxury beyond traditional terrestrial offerings

Strategic partnerships between aerospace manufacturers and hospitality brands creating integrated tourism ecosystems

Advanced spacecraft safety systems building consumer confidence through enhanced reliability protocols

Emerging spaceport infrastructure development across multiple continents facilitating operational scalability

Media coverage and successful commercial flights generated widespread public interest and aspirational demand.

The space tourism industry stands at an inflection point where multiple convergent forces are transforming what was once science fiction into accessible commercial reality. Technological maturation represents the foundational pillar enabling this market expansion, with reusable launch vehicle systems fundamentally altering the economic equation. Traditional expendable rockets created prohibitive cost barriers, but contemporary spacecraft designed for multiple missions distribute development expenses across numerous flights, creating unprecedented affordability trajectories. Propulsion innovations, composite material engineering, and autonomous flight control systems have collectively enhanced reliability while compressing turnaround times between missions, enabling operators to achieve economies of scale previously considered unattainable in human spaceflight operations.

Regulatory evolution has emerged as a critical enabler, with national aviation authorities and international bodies establishing coherent frameworks that balance safety imperatives with commercial flexibility. Progressive licensing regimes now accommodate experimental spacecraft categories while maintaining rigorous standards for passenger protection, crew qualification, and environmental considerations. These regulatory architectures provide the legal certainty that capital markets demand, facilitating substantial investment flows into spacecraft development programs and supporting infrastructure. Governments worldwide recognize space tourism as both an economic opportunity and a catalyst for broader aerospace sector advancement, leading to policy initiatives that encourage domestic industry development while fostering international operational standards harmonization.

Consumer psychology dynamics are fundamentally reshaping luxury experiential markets, with aspirational travelers increasingly prioritizing transformative experiences over material possessions. Space tourism satisfies this demand at its apex, offering perspectives and sensations literally unavailable anywhere on Earth. The overview effect—a cognitive shift reported by astronauts viewing Earth from space—represents a unique value proposition that resonates with experience-seeking demographics. Market research indicates strong correlation between participation interest and individuals who have exhausted conventional adventure tourism options, positioning space travel as the ultimate frontier for those seeking novelty and exclusivity. This psychological dimension creates pricing resilience, as early adopters demonstrate willingness to allocate significant resources toward bucket-list achievements.

Infrastructure development momentum is accelerating across geographic regions, with purpose-built spaceports transitioning from conceptual proposals to operational facilities. These specialized facilities incorporate passenger processing amenities, mission control capabilities, and regulatory compliance infrastructure tailored specifically for commercial human spaceflight operations. Beyond launch complexes, complementary ecosystems are emerging encompassing training facilities where participants undergo physiological preparation and simulation experiences, creating extended engagement touchpoints that enhance overall customer journey value. Hospitality integration represents another infrastructure dimension, with specialized accommodation facilities near launch sites offering immersive pre-flight experiences that extend revenue opportunities beyond the flight itself.

Corporate partnership configurations are establishing integrated value chains that leverage complementary organizational competencies. Aerospace engineering firms contribute technical expertise and manufacturing capabilities while hospitality corporations inject customer experience design excellence and luxury service delivery frameworks. These collaborations enable space tourism operators to deliver comprehensive offerings that meet exacting safety standards while creating memorable customer interactions across all journey phases. Insurance providers, medical specialists, and content production companies further populate this ecosystem, each contributing specialized capabilities that collectively elevate industry professionalism and operational sophistication.

Examining segmentation by type reveals distinct market dynamics shaping growth trajectories. Accessible pricing tiers are democratizing participation opportunities, allowing broader demographic segments to engage with space tourism experiences. Entry-level offerings emphasize operational efficiency and passenger throughput optimization, utilizing spacecraft configurations that maximize capacity while maintaining safety protocols. This segment attracts first-time participants and experience-curious consumers who prioritize accessibility over extended duration or altitude extremes. Conversely, premium pricing categories target ultra-luxury positioning, incorporating bespoke customization, extended mission durations, and enhanced comfort amenities that justify significant price premiums.

Application segment analysis demonstrates varied growth patterns across different flight profiles. Lower-altitude experiences emphasize accessibility and operational frequency, utilizing aircraft-based platforms that require minimal specialized infrastructure and offer gentler physiological demands suitable for broader participant demographics. These missions prioritize atmospheric boundary experiences, delivering weightlessness intervals and curvature visualization within compressed timeframes that minimize training requirements and physical screening stringency. Mid-altitude profiles extend mission parameters, incorporating rocket-powered ascent phases that deliver higher apogee achievements and extended microgravity durations, appealing to participants seeking more intensive experiences with corresponding willingness to undergo rigorous preparation protocols. Extended-duration missions represent the premium application tier, offering sustained orbital presence that enables comprehensive Earth observation, prolonged weightlessness exposure, and potential accommodation aboard dedicated facilities, commanding premium pricing while requiring extensive participant preparation and medical qualification.