The age of disposable satellites is ending. What once launched as static instruments destined for fixed orbits now dance through space with ballet-like precision. SmallSats—satellites weighing between 1 to 500 kilograms—have evolved from simple communications relays into agile spacecraft capable of complex orbital choreography. This transformation centers on one critical capability: maneuverability.

The stakes are substantial. The global small satellite market size was valued at USD 8.45 billion in 2024 and is projected to grow from USD 9.89 billion in 2025 to reach USD 25.32 billion by 2033, exhibiting a CAGR of 12.45% during the forecast period. Yet beneath these impressive growth projections lies a more fundamental shift. SmallSats are no longer confined to predetermined paths. They can adjust orbits, form constellations, avoid collisions, and extend operational lifespans through precise propulsion and navigation systems. This agility transforms them from commodity hardware into strategic assets capable of competitive endurance missions.

The investment community has taken notice. In Q2, Space Economy investments total $7.8B across 113 companies. There has now been $29.0B invested into 392 unique space companies in the last 12 months. But smart money follows capability, not hype. The real question for entrepreneurs and investors becomes: which maneuverability technologies will define the next generation of space commerce?

The Propulsion Revolution: Small Thrusters, Big Impact

Traditional satellites relied on chemical propulsion systems designed for major orbital adjustments. SmallSats demanded something different—propulsion systems that could operate continuously, consume minimal power, and fit within severe weight constraints. The answer emerged through electric propulsion, cold gas systems, and innovative hybrid approaches that prioritize precision over raw thrust.

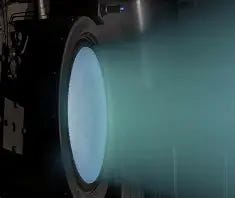

Electric propulsion dominates the current landscape. Ion thrusters and Hall effect thrusters generate thrust by accelerating ionized propellant through electromagnetic fields. While producing modest thrust levels—often measured in millinewtons—these systems achieve remarkable specific impulse, the key metric for fuel efficiency. A single SmallSat equipped with electric propulsion can maintain its orbit for years, performing thousands of small adjustments that would quickly exhaust chemical propellant supplies.