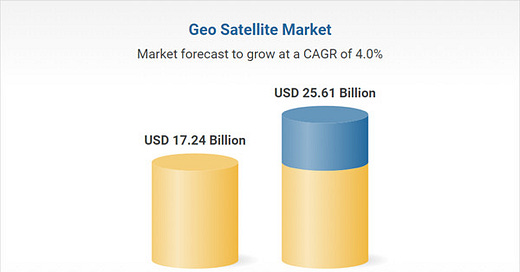

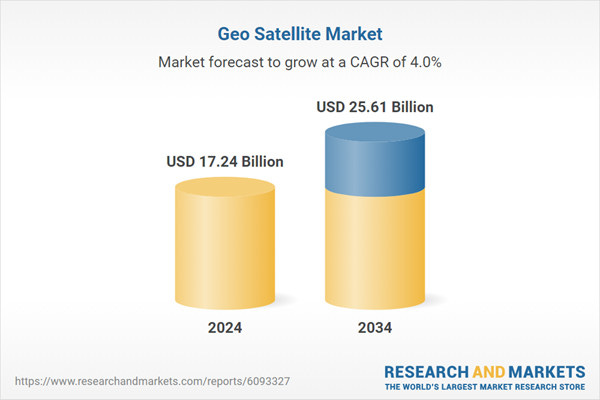

The global GEO satellite market reached a value of nearly $17.24 billion in 2024, and is expected to grow from $17.24 billion in 2024 to $21.32 billion in 2029 at a rate of 4.34%. The market is then expected to grow at a CAGR of 3.73% from 2029 and reach $25.61 billion in 2034, according to a new report from ResearchandMarkets.

Analysts find the market to be highly concentrated, with a large number of small players operating in the market. The top ten competitors in the market made up to 53.9% of the total market in 2023. SES S.A. was the largest competitor with a 9.35% share of the market, followed by Eutelsat Communications SA with 6.71%, Intelsat with 5.35%, The Boeing Company with 5.28%, Lockheed Martin Corp. with 4.80%, Airbus SE with 4.77%, Thales Alenia Space S.A.S. with 4.66%, OHB System AG with 4.60%, Hispasat S.A. with 4.19% and EchoStar Corporation with 4.16%.

Growth in the historic period resulted from expansion of satellite-based communication networks, increasing commercial space sector investments, increasing need for high-speed internet and 5G technology. Factors that negatively affected growth in the historic period was satellite congestion and orbital debris and limited private sector involvement. Going forward, growth in demand for high-resolution earth observation data, government funding and space agency investments, increasing investments in satellite, telecommunication boom and growing use of satellite communication in defense applications will drive the growth. Factor that could hinder the growth of the GEO satellite market in the future include high launch and manufacturing costs and regulatory challenges and spectrum allocation issues.

North America was the largest region in the GEO satellite market, accounting for 47.93% or $8.26 billion of the total in 2024. It was followed by Asia-Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the GEO satellite market will be Asia-Pacific and Eastern Europe where growth will be at CAGRs of 5.30% and 5.26% respectively. These will be followed by Middle East and Africa where the markets are expected to grow at CAGRs of 5.14% and 5.02% respectively.

By propulsion technology, the market is segmented into electric, gas-based, and liquid fuel propulsion. The electric market was the largest segment of the GEO satellite market segmented by propulsion technology, accounting for 49.85% or $8.59 billion of the total in 2024. Going forward, the electric segment is expected to be the fastest growing segment in the GEO satellite market segmented by propulsion technology, at a CAGR of 6.21% during 2024-2029.

By mass, the above 1000kg market was the largest segment of the GEO satellite market segmented by satellite mass, accounting for 63.05% or $10.87 billion of the total in 2024. Going forward, the 10-100kg segment is expected to be the fastest growing segment in the GEO satellite market segmented by satellite mass, at a CAGR of 7.82% during 2024-2029.

In terms of end users, the commercial market was the largest segment of the GEO satellite market segmented by end user, accounting for 66.24% or $11.42 billion of the total in 2024. Going forward, the commercial segment is expected to be the fastest growing segment in the GEO satellite market segmented by end user, at a CAGR of 4.75% during 2024-2029.

The communication market was the largest segment of the GEO satellite market segmented by application, accounting for 63.36% or $10.92 billion of the total in 2024. Going forward, the communication segment is expected to be the fastest growing segment in the GEO satellite market segmented by application, at a CAGR of 4.64% during 2024-2029.

The top opportunities in the market segmented by propulsion technology will arise in the electric segment, which will gain $3.01 billion of global annual sales by 2029. The top opportunities in the GEO satellite market segmented by satellite mass will arise in the above 1000kg segment, which will gain $1.85 billion of global annual sales by 2029. The top opportunities in the GEO satellite market segmented by application will arise in the communication segment, which will gain $2.77 billion of global annual sales by 2029. The top opportunities in the GEO satellite market segmented by end user will arise in the commercial segment, which will gain $2.98 billion of global annual sales by 2029. The GEO satellite market size will gain the most in the United States at $1.25 billion.

Market-trend-based strategies for the market include a focus on entering into strategic partnerships, focus on products expansion, such as small geostationary satellite, focus on developing innovative products, such as weather satellites, to provide continuous, real-time, and wide-area monitoring and focus on developing technologically advanced products, such as remote-sensing satellites, providing high-resolution, real-time, and comprehensive data.

Player-adopted strategies in the GEO satellite market include focus on expanding its operational capabilities through new product launches, focus on expanding its operational capabilities through partnership agreements and focus on strengthening its business operations through securing new contracts.

To take advantage of the opportunities, the ResearchandMarket analysts recommend that GEO satellite companies to focus on expanding weather monitoring capabilities, focus on expanding small geo satellite offerings, focus on advancing remote-sensing satellite capabilities, focus on the electric propulsion segment to drive growth, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships to accelerate innovation, provide competitively priced offerings, continue to use B2B promotions, focus on the communication segment to maximize market growth, focus on the commercial segment to capture high-growth demand.