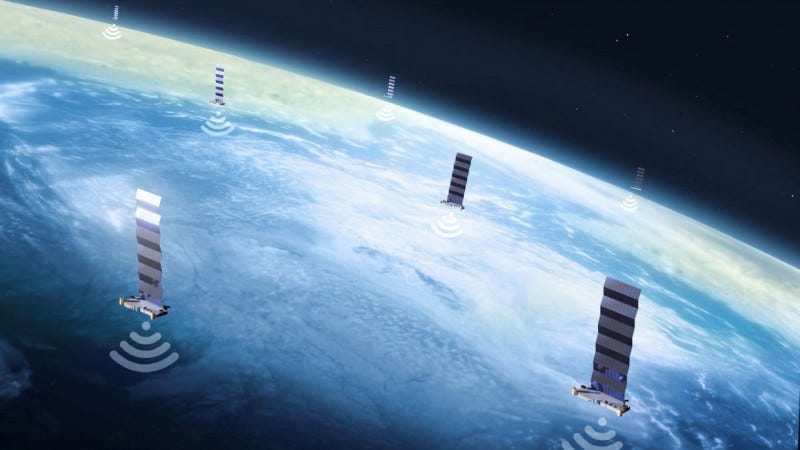

NGSO Services to Dominate Maritime Satellite Communications Market

'The Starlink Effect' Driving Market Growth

In the 13th edition of the Novaspace "Prospects for Maritime Satellite Communications" report, the space consulting and market intelligence firm assesses the key trends and developments impacting this rapidly growing market.

“Starlink disrupted the maritime satcom market via its official service launch, influencing the direction of the market in almost e…