Multiple Factors Propel Earth Observation Geospatial Data Services Market

Revenue Could Reach $15 Billion by 2030: Report

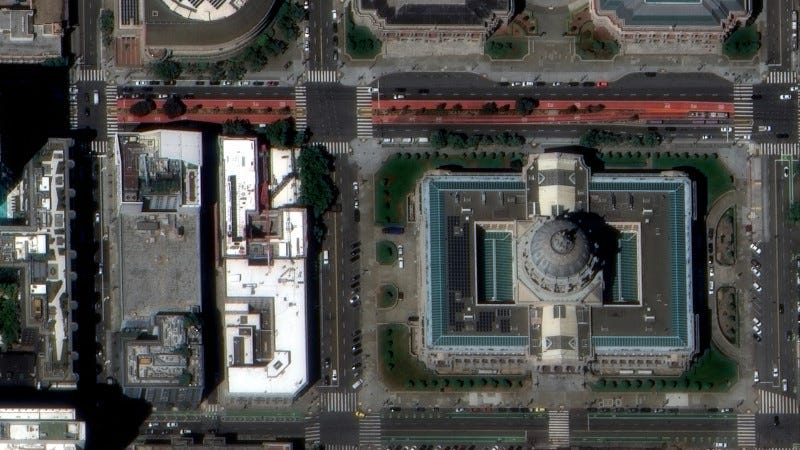

Global demand for Earth observation (EO) geospatial data is rising, driven by increased interest and investment in geospatial intelligence. According to global technology intelligence firm ABI Research, the EO sector is projected to generate $15 billion in revenue by 2030. Europe is expected to lead with the highest compound annual g…