Market Reports and Partnership Agreements

Checking the Top Stories from the Journal of Space Commerce for the Week Ending 10/27

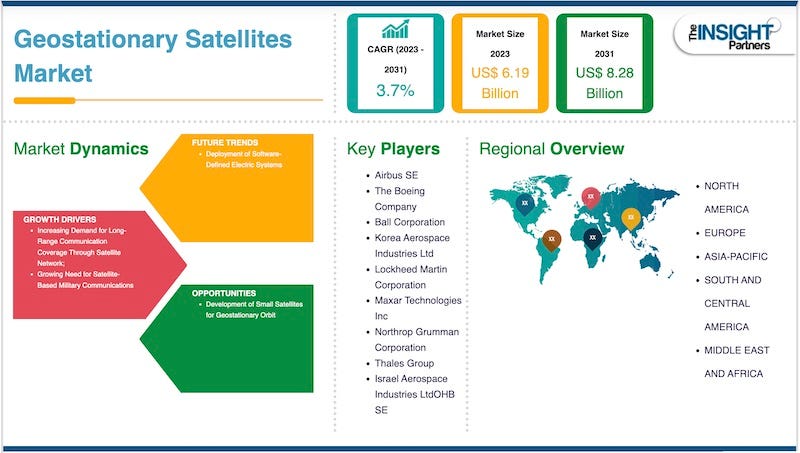

A pair of satellite reports out this week point to rapid growth in GEO and Communications Satellites markets.

The market for geostationary satellites is projected to grow to $8.28 billion by 2031, according to a new report from The Insight Partners. The report credits the growth forecast to the rising demand for satellite-based military communications an…