Maritime Satellite Communication Value Chain Grows

Non-Geostationary Orbit Solutions Come a Significant Market Driver

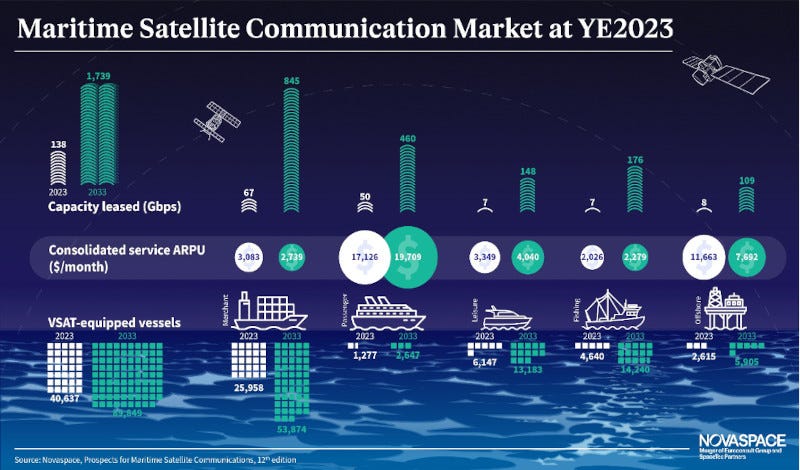

The maritime satellite communication market experienced significant growth in 2023. The growth has been driven primarily by Starlink's entry into the market following the official launch of its maritime service, which has rapidly gained traction and boosted the number of VSAT-equipped vessels.

“The maritime satcom market continued to be highly dynamic in…