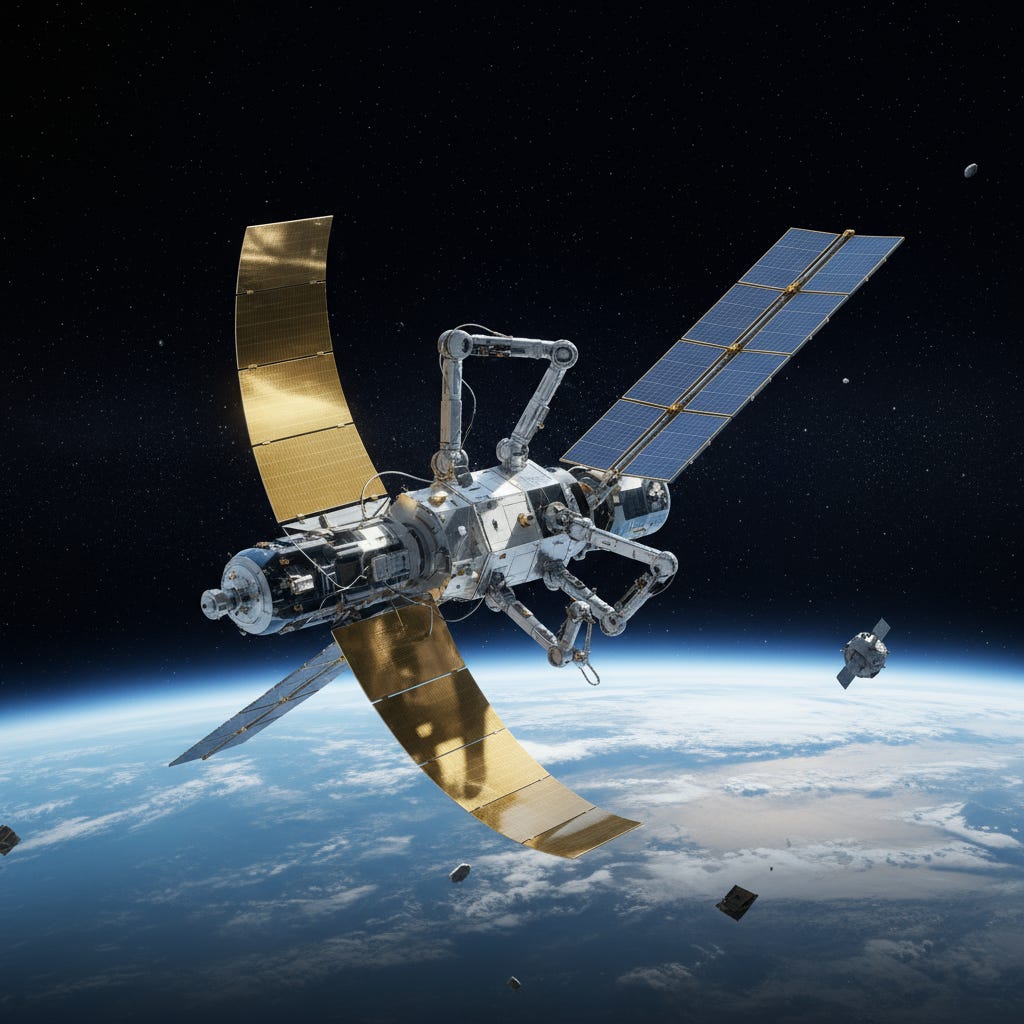

In the high-stakes arena of space commerce, where satellites worth hundreds of millions drift toward obsolescence due to dwindling fuel, Infinite Orbits emerges as a pragmatic innovator. Founded in 2017 and now headquartered in Toulouse, France, this NewSpace trailblazer specializes in in-orbit servicing—think autonomous “space mechanics” that inspect, …

Substack is the home for great culture