Eutelsat Reports Mixed H1 Results as LEO Business Surges

LEO constellation revenues jumped 59.7 Percent

Eutelsat Communications reported total revenues of €592 million (≈$704 million) for the first half of fiscal 2025-26, down 2.4% on a reported basis but stable like-for-like. The Paris-based satellite operator announced the results on February 13.

“We significantly strengthened our financial foundations through the successful execution of our refinancing plan.”

Jean-François Fallacher, Eutelsat

The company’s LEO constellation revenues jumped 59.7 percent to €111 million (≈$132 million), now accounting for approximately 20 percent of total revenues. However, adjusted EBITDA declined 6.1percent like-for-like to €308 million (≈$366 million), with the margin falling 3.4 points to 52.1 percent. The company attributed the margin pressure to sanction-related video revenue losses and product mix effects during the LEO ramp-up phase.

“The first half of FY 2025-26 marked a decisive step forward for Eutelsat. We significantly strengthened our financial foundations through the successful execution of our refinancing plan, supported by our shareholders, rating agencies, and institutional partners,” said Jean-François Fallacher, Eutelsat Communications CEO. “At the same time, we secured the long-term operational continuity and technological evolution of our LEO constellation, reinforcing our ability to serve customers with greater performance and flexibility. With financing secured and our growth strategy clearly on track, we are entering the next phase with confidence, focused on unlocking the full potential of our LEO business and delivering sustainable value for all stakeholders.”

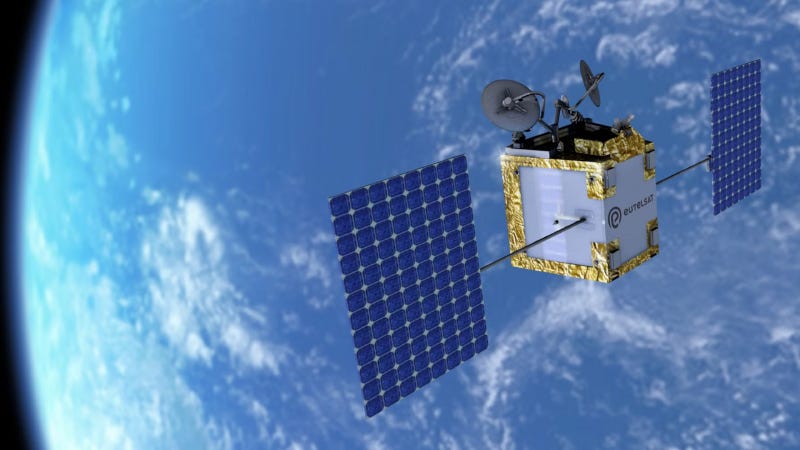

Eutelsat operates a fleet of 33 geostationary satellites and a Low Earth Orbit constellation of more than 600 satellites, serving customers in video, mobile connectivity, fixed connectivity, and government services.