CubeSat Market to Reach $1.6 Billion in Eight Years: Report

Annual Growth Forecast is Projected to be More Than 15 Percent

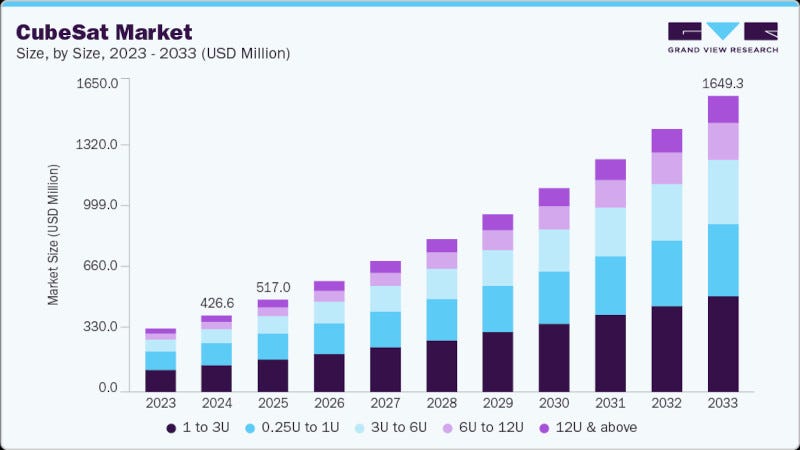

The global CubeSat market size was estimated at $426.6 million in 2024, and is projected to reach $1.65 billion by 2033, growing at a CAGR of 15.6% from 2025 to 2033. According to a new report from Grand View Research, the market growth is primarily driven by the increasing demand for low-cost satellite missions, rising adoption of CubeSats for Earth observation and remote sensing, and advancements in miniaturized satellite technologies.

The surge in demand for earth observation and remote sensing is unlocking new revenue streams for the CubeSat industry. Government agencies and private firms are investing in compact satellites to monitor agricultural patterns, climate change, and urban development. These missions require cost-effective deployment without compromising data accuracy. The CubeSat industry is capitalizing on this momentum through high-resolution payload integration and rapid constellation launches.

Rising interest in space-based Internet of Things (IoT) applications is accelerating the development of CubeSat constellations. Industries like agriculture, maritime, and energy are increasingly relying on satellite connectivity for asset tracking in remote locations. The need for low-latency communication and persistent coverage is pushing innovation in networked CubeSat architectures. This shift is enabling the CubeSat industry to play a pivotal role in the global IoT infrastructure expansion.

Military and defense sectors are scaling their reliance on CubeSats for rapid-response surveillance and tactical intelligence. The demand for agile, deployable systems that enhance situational awareness and secure communications is shaping procurement strategies. Governments are allocating dedicated budgets toward space-based ISR (Intelligence, Surveillance, and Reconnaissance) capabilities through CubeSat platforms. Consequently, the CubeSat industry is becoming integral to national security frameworks and modern defense infrastructure.

Regulatory evolution and frequency allocation policies are shaping operational norms in the CubeSat industry. Global regulatory bodies are streamlining licensing and orbital debris mitigation frameworks to accommodate the rapid growth in small satellite deployments. Improved governance is fostering investor confidence and long-term scalability. The CubeSat industry is responding with enhanced compliance protocols and sustainable deployment strategies.

The 1 to 3U segment dominated the market with a revenue share of over 35% in 2024, owing to its balance between compact size and functional capability. This size of CubeSat segment has remained a preferred choice for a wide range of Low-Earth orbit missions. This form factor is widely adopted for Earth observation, scientific experiments, and communication applications due to its lower launch costs and quicker development timelines. Advancements in miniaturized payloads and integrated subsystems are enhancing mission versatility within this size class. However, as demand shifts toward higher-performance and multi-payload missions, the segment may face increasing competition from larger CubeSat configurations.

The 6U to 12U segment is expected to register the fastest CAGR of over 19% from 2025 to 2033, driven by the increasing demand for high-performance payloads and multi-functional mission capabilities. The 6U to 12U CubeSat segment is experiencing rapid growth. This size class offers greater power, onboard storage, and space for advanced instruments, making it ideal for high-resolution imaging, secure communications, and autonomous operations. Government agencies and commercial operators are adopting 6U to 12U platforms for more complex and longer-duration missions. The segment is emerging as a strategic choice for next-generation CubeSat deployments that require enhanced functionality without transitioning to full microsatellite platforms.

Application Insights

Earth observation dominated the market in 2024, driven by growing demand for real-time environmental intelligence.

The communication segment is expected to grow at the fastest CAGR in the coming years, fueled by the rising need for global connectivity and low-latency data services.

Subsystem Insights

The payloads segment dominated the market in 2024, driven by the need for advanced sensing, imaging, and communication capabilities.

The attitude determination & control systems (ADCS) segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing need for precise satellite orientation and stabilization.

End Use Insights

The government & defense segment dominated the market in 2024, driven by the increasing demand for rapid, cost-effective, and mission-flexible space assets in this sector. Defense and space agencies are turning to CubeSats for applications such as reconnaissance, early warning systems, and secure communications.

The commercial segment is expected to grow at the fastest CAGR in the coming years, primarily driven by the surge in demand for real-time data services, Earth observation, and global connectivity.

Regional Insights

North America CubeSat market dominated the market with a revenue share of over 46.0% in 2024, owing to the maturity of its space infrastructure and growing demand for low-orbit connectivity solutions.

The U.S. CubeSat market dominated the market with a revenue share of over 66% in 2024, as collaboration between tech startups and research institutions continues to expand.

The Europe CubeSat market is expected to grow at a CAGR of 14.0% from 2025 to 2033, fueled by climate-focused satellite missions and pan-European collaborative programs.

The Asia Pacific CubeSat market is expected to grow at the fastest CAGR of 20.1% from 2025 to 2033, owing to rapidly advancing national space programs and increasing commercial launch frequency.