Capital Increase of $1.56 Billion Contemplated by Eutelsat

Would Secure the Execution of the Company's Long-Term Strategic Vision

A contemplated capital increase of €1.35 billion (≈$1.56 billion) has been announced by Eutelsat. Anchored by key reference shareholders, the increase would secure the execution of long-term strategic vision.

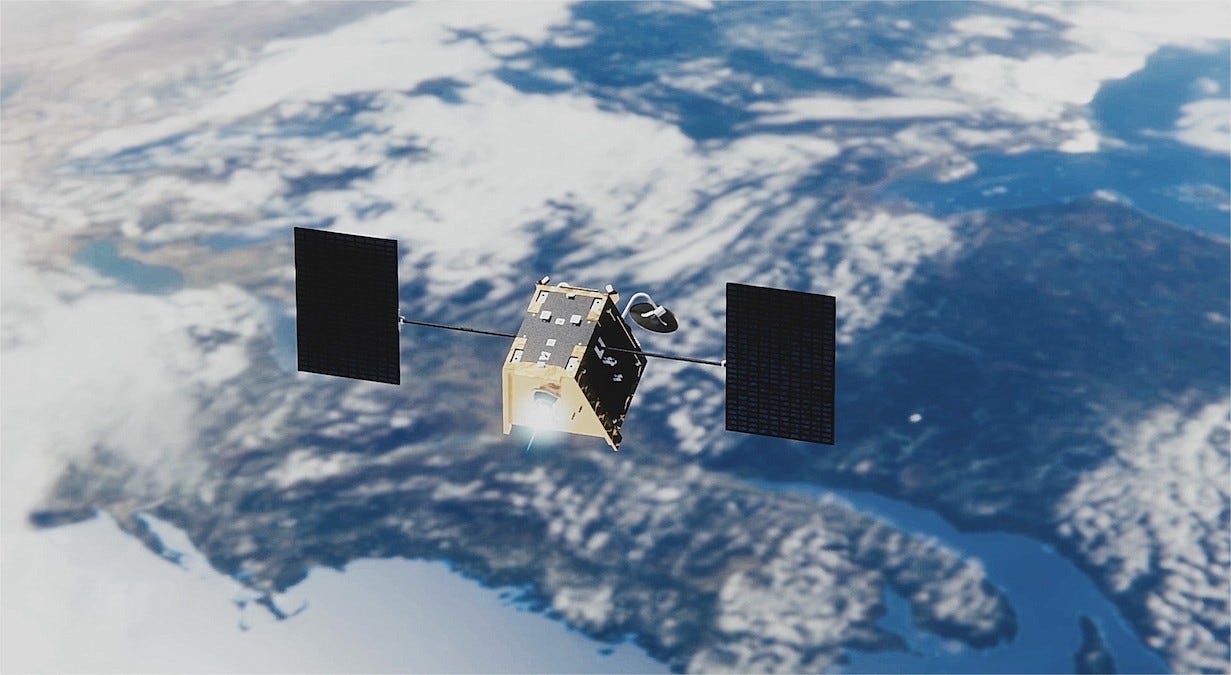

Eutelsat is one of only two global operators with active commercial LEO (Low Earth Orbit) fleets and with a clear differentiation, being the only o…