California Satellite Data Purchase Contract Awarded

Planet is a Subcontractor for the $95 Million Award

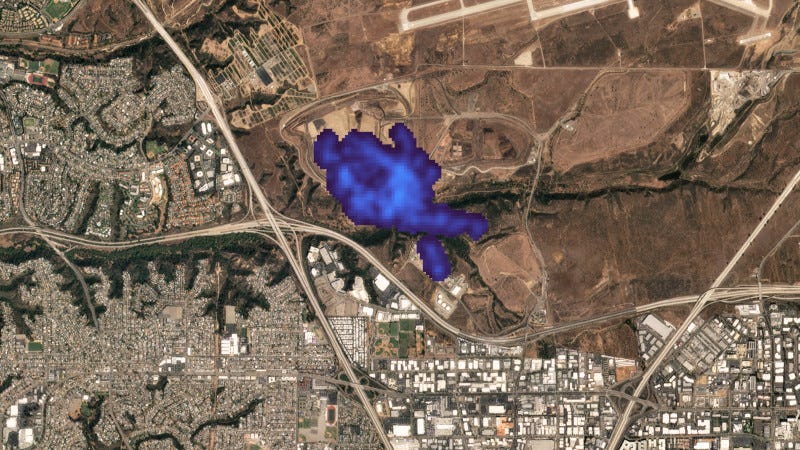

The California Air Resource Board’s (CARB) Satellite Data Purchase Program (SDPP) has selected Planet as the primary contractor for a $95 million multi-year contract. The Earth Observation company has also released financial results for the period ending January 31.

“Last year was an exciting and transitional…