Boeing's Space Ambitions: Navigating Turbulence in the Commercial Space Economy

Boeing stands at a crossroads in the commercial space industry. Once a dominant force in aerospace with decades of experience supporting America's most ambitious space endeavors, the company now faces mounting challenges that threaten its position in the rapidly evolving space commerce sector. With losses on its Starliner program exceeding $2 billion and growing questions about its space strategy, Boeing's journey illustrates both the promise and perils of commercial space ventures.

Company Foundation and Strategic Vision

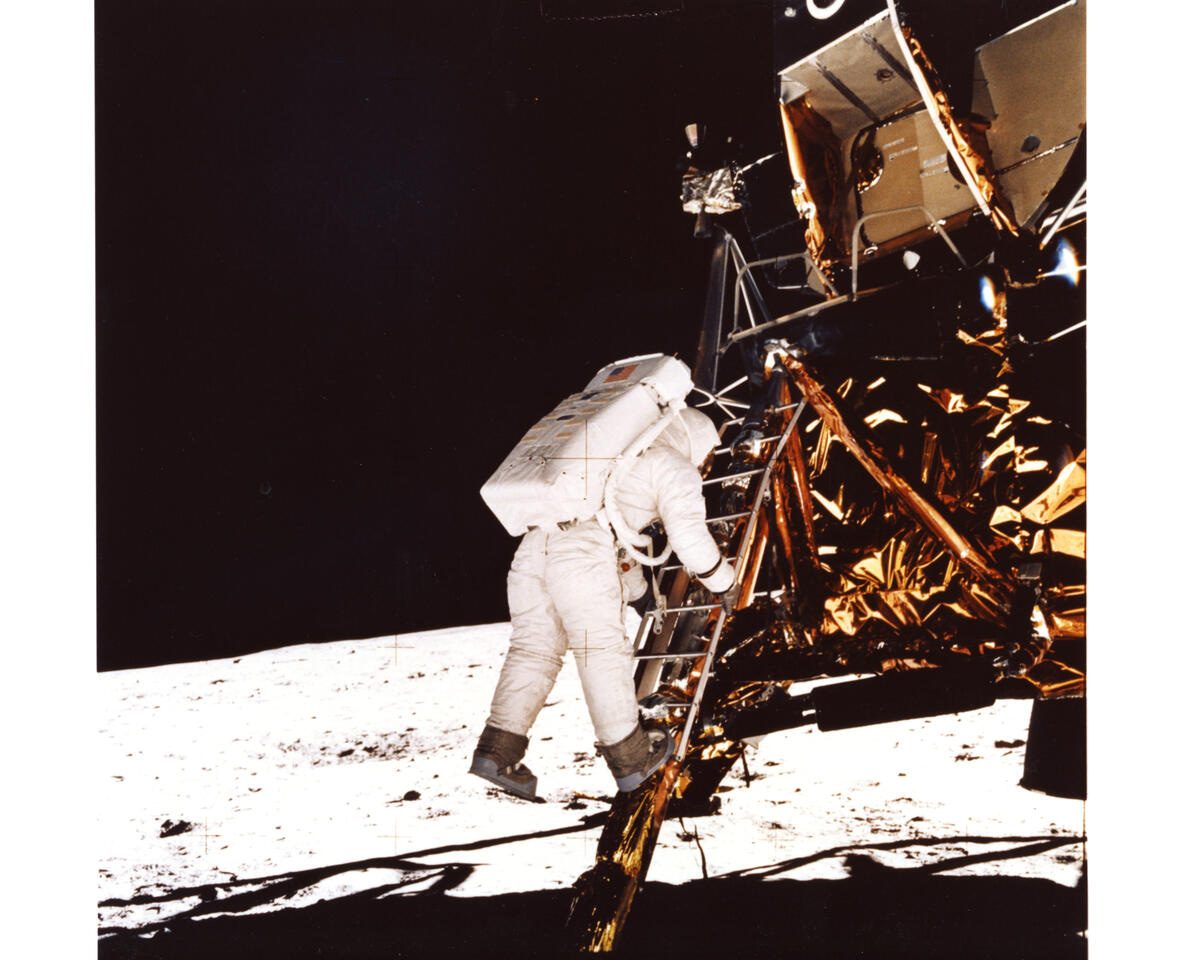

Boeing's space heritage traces back to the Apollo era, where the company played integral roles in virtually every major U.S. space program. According to Boeing's official communications, the company “leverages experience gained from supporting every major U.S. endeavor to escape Earth's gravity as it designs and builds what it characterizes as the future of safe, assured space exploration and commercial access.”

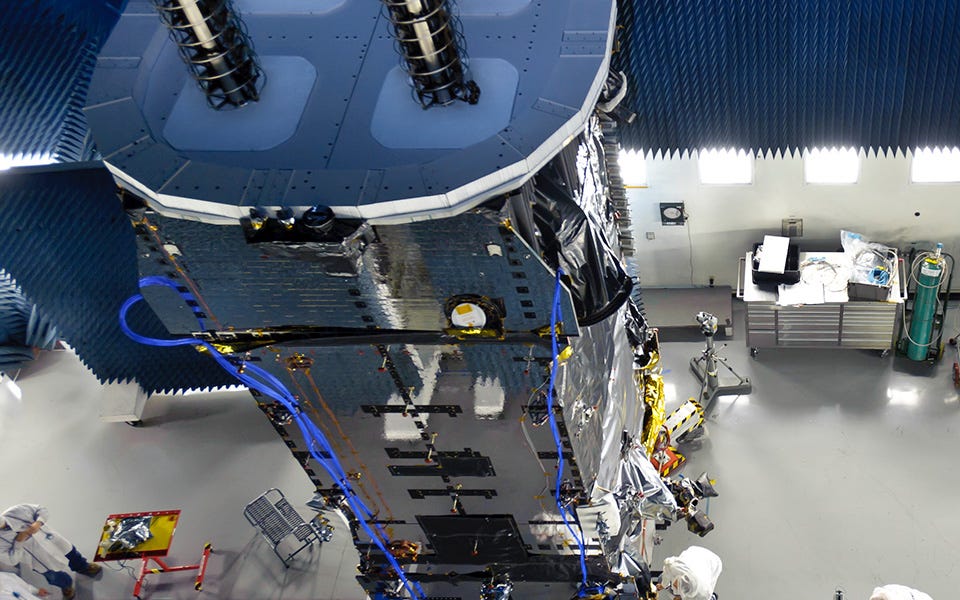

The aerospace giant's current space strategy centers on several key pillars: crew transportation through the CST-100 Starliner spacecraft, satellite manufacturing and services, and supporting International Space Station operations. Boeing's corporate leadership has worked to position the company as a bridge between government space programs and the emerging commercial space economy, citing decades of institutional knowledge to compete with newer, more agile competitors like SpaceX.

Boeing's space vision has evolved significantly since the company's founding. The company has shifted from primarily serving as a government contractor to pursuing commercial opportunities, though this transition has proven more challenging than anticipated. The space division operates under Boeing Defense, Space & Security, reflecting its continued reliance on government contracts while pursuing commercial growth.